685 The total of all income taxes for an area including state county and local taxes. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the state.

Connecticut Taxes Lower Than New York S For Everyone But The Poor Ct Voices

Connecticut Taxes Lower Than New York S For Everyone But The Poor Ct Voices

This extra exemption is limited to seniors whose income is less than 86000.

Income tax percentage in ny. 875 The total of all sales taxes for an area including state county and local taxes. New York State income tax rates range from 4 to 882 for the 2019 tax year depending on a taxpayers income. For single taxpayers living and working in the state of New York.

However they accounted for 370 percent of total PIT liabilitya collective 157 billion or about one out of every six state operating funds dollars. 805 cents per gallon of regular gasoline 800 cents per gallon of diesel. Your income could include.

New York Earned Income Tax Credit EITC - 30 of your qualified federal EITC minus any household credit Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income. 3078 - 3876 in addition to state tax Sales tax. The following state tax credits are valid for all qualifying New York residents.

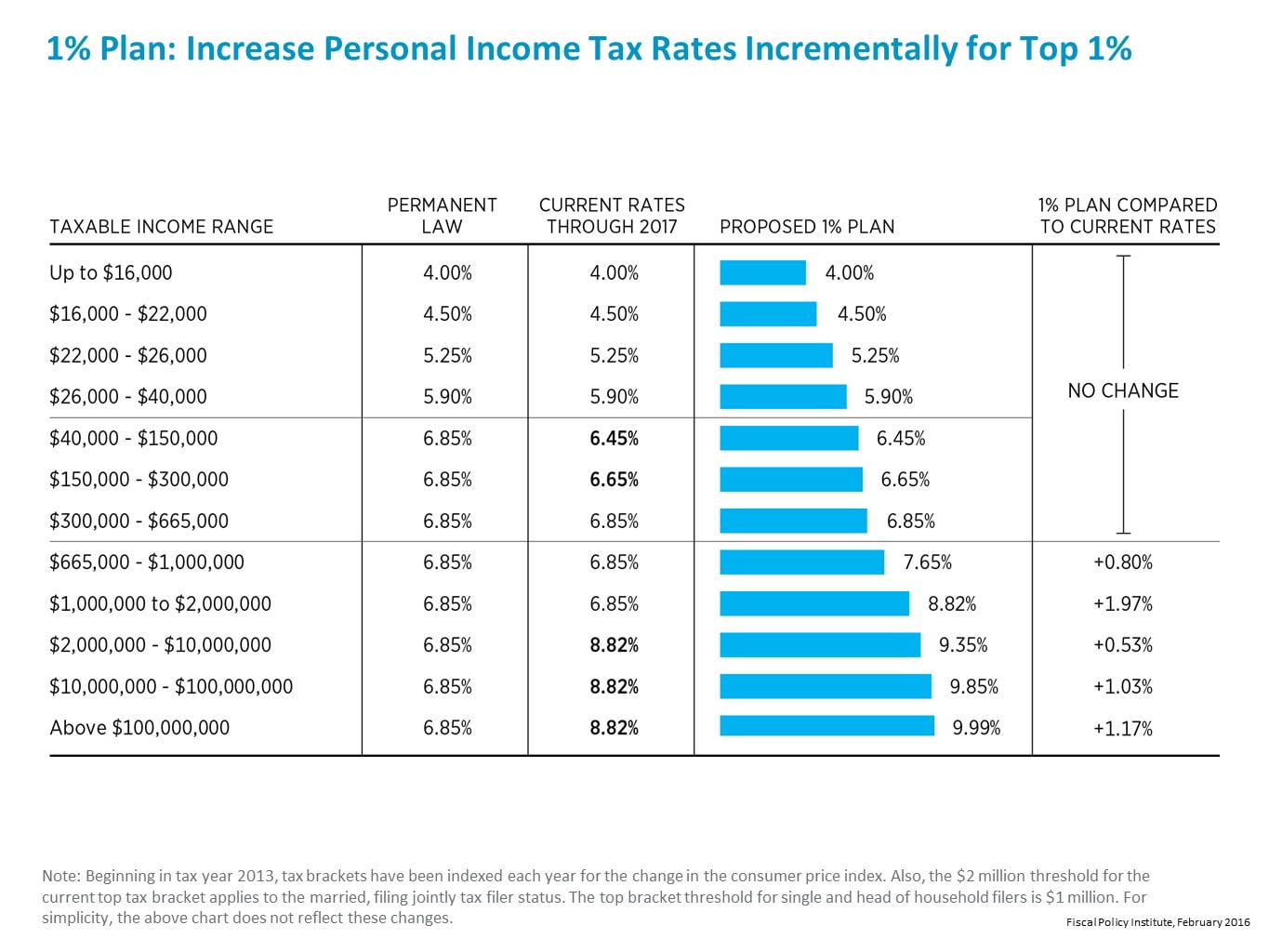

New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. New York taxpayers with taxable income of 1 million or more accounted for just 10 percent of all filers in tax year 2016. Money from renting out property.

New York State Income Tax New York State income tax rates range from 4 to 1090 for the 2021 tax year depending on a taxpayers income. New York City Income Tax Rates. 4 - 882 NYC income tax.

Thats the deal only for federal. The lowest rate applies to the first 8500 of taxable income for single filers and it increases incrementally from there. It will also create new tax brackets for income above 5 million.

New York City has four tax brackets ranging from 3078 to 3876. Exempt from federal income tax but subject to New York income tax. Taxes on Your Home.

If you are a nonresident you are not liable for New York City personal income tax but may be subject to Yonkers nonresident earning tax if your income. The Enhanced STAR exempts the first 65300 of the full value of a home from school property taxes. Federal income taxes are not included Property Tax Rate.

New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status. 169 average effective rate Gas tax. 3 See Figure 2.

Tax rate of 525 on taxable income between 11701 and 13900. A Work and Income benefit. As a resident you pay state tax and city tax if a New York City or Yonkers resident on all your income no matter where it is earned.

The states tax rates consistently rank among the nations highest and it also imposes an estate tax. Tax rate of 4 on the first 8500 of taxable income. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

Income tax rates are the percentages of tax that you must pay. Once a homeowner reaches age 65 he or she can apply for an Enhanced STAR school tax reduction. 1915 The property tax rate shown here is the rate per 1000 of home value.

103 percent for income between 5 million and 25 million and 109 percent. That 14 is called your effective tax rate. Interest from a bank account or investment.

2 The subtraction modification applies only if the fund meets the 50 US. The state charges a flat 4 rate but your actual rate can vary based on any local sales tax imposed by the city county or school district in which the sale occurs. Obligations asset requirement under section 612c 1 of the Tax.

Overview of New York Taxes. Rates kick in at different income levels depending on your filing status. Taxes in New York State income tax.

Tax Rates for New York NY. New Yorks income tax rate for annual earnings above 1 million will rise to 965 from its current 882 under the latest deal. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. New York offers the STAR program to reduce school property taxes for homeowners who have less than 500000 in income. Tax rate of 45 on taxable income between 8501 and 11700.

In New York two new personal income tax brackets would be temporarily created. 4 - 8875 Property tax. The rates are based on your total income for the tax year.

For example the sales tax rate for New York City is 8875 while its 75 in Ontario County. However any taxable income from annuities or IRAs is NOT included in the income.