Calculate the final price after a discount with a simple intuitive experience and minimal effort. Interest will not be waived.

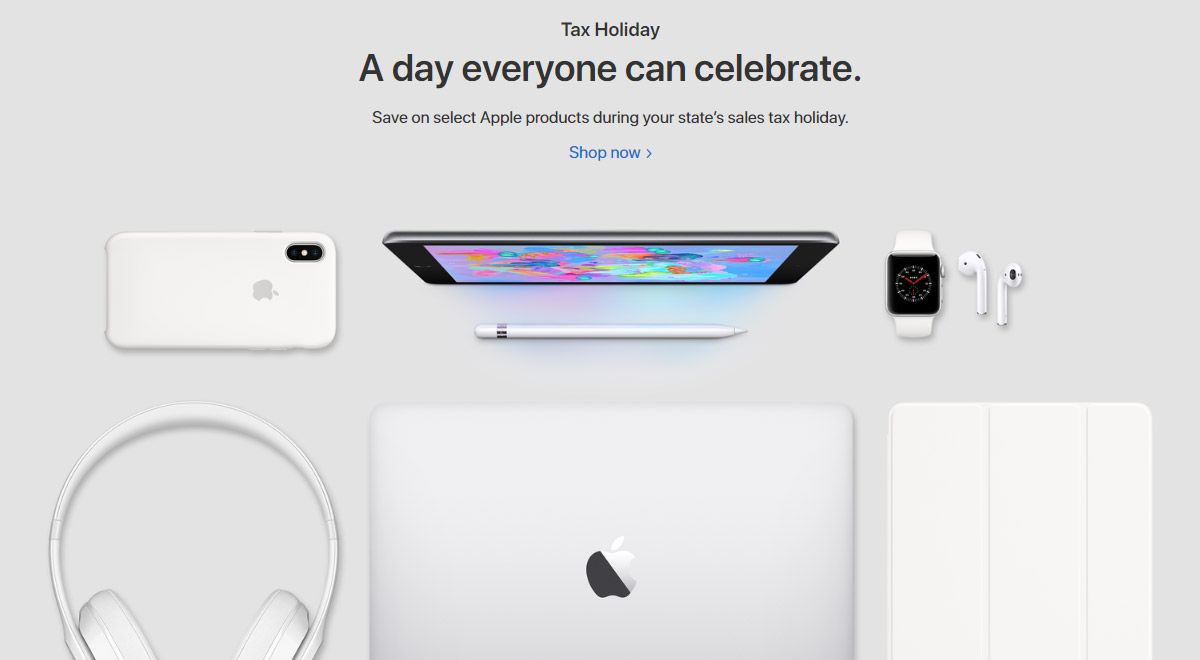

Here Are The Apple Products Eligible For 2018 Sales Tax Holiday In Your State Redmond Pie

Here Are The Apple Products Eligible For 2018 Sales Tax Holiday In Your State Redmond Pie

19 includes 6 months of updates support 79 lifetime updates support.

Salestax apple com. All 50 US states sales tax rates in one handy csv file. The use tax generally applies to the storage use or other consumption in California of goods purchased from retailers in transactions not. In der Regel fallen für den Abschluss einer Mitgliedschaft die jeweiligen Steuern Ihrer Region oder Ihres Bundeslandes an.

Include your mailing address a copy of the receipt for the purchase and a copy of your institutions tax exemption certificate. Unlike the value added tax a sales tax is imposed only at the retail level. Link to this Post.

Welcome on Sales Tax States. Feb 14 2012 209 PM Reply Helpful 10 Thread reply - more options. Sales Tax Calculator Hareshbhai Issamaliya 20 1 Rating.

Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. Payment Of Sales Tax. We have taken one of the best-selling Discount and Sales tax calculator apps on the app store for the last 10 years and made it even better.

Sales tax vs. 51 Zeilen Illinois IL Sales Tax Rates. Discover the innovative world of Apple and shop everything iPhone iPad Apple Watch Mac and Apple TV plus explore accessories entertainment and expert device support.

If you buy in a store you pay the sales tax for the location of the store if you buy online you pay the sales tax for the address the purchase is shipped to. Sales tax is calculated by multiplying the purchase price by the applicable tax rate. Floridas general state sales tax rate is 6 with the following exceptions.

In cases where items are sold at retail more than once such as used cars the sales tax can be charged on the same item. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Goods subject to specific rate.

We ask that you file the sales tax returns that are due make a good faith payment and contact our Enforcement Hotline at 800-252. EveryDay Calculators is a collection of 6 calculators designed to help with situations we think most people will encounter on a regular basis The calculators are easy and intuitive to use Discount Sales Tax Calculator is. We added 5 more calculators.

Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase. The incidence of tax is provided under. Until the sale is made to the final consumer sales tax is not.

There are around 4000 different taxing jurisdictions in the US. Just enter your sale price choose your discount percentage and let the calculator do the math. Wed Jul 01 2020.

Sales tax can include state county and. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Get precise United States sales tax calculator.

Taxpayers may be able to enter into short-term payment agreements with possible waiver of penalties. Yes sales tax is charged for any purchase. On Sales Tax States states sales tax is the most general cities will give you a US sales tax calculator with a bit more precision and zip code is your best choice.

There is a difference however. First Page 1 of 1 Page 11. Sales tax is collected by the retailer when the final sale in the supply chain is reached.

In other words end consumers pay sales tax when they purchase goods or services. Discount Calculator is the ideal shopping companion. Download Now - 19 29 Lifetime Updates - 79.

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Goods subject to 20. Often laws provide for the exemption of certain goods or services from sales and use tax such as.

Goods subject to 5. Enter your desired United States zip code to get more accurate sales tax rate. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

The seller collects it at the time of the sale. Easily calculate Sales Tax based on your location the app also calculates the final price for your product adding as many discounts as needed and also includes a global library of taxes per Country like the taxes by city and state in the US or by Province in Canada Our. Sales Tax is imposed on imported and locally manufactured taxable goods.

ALTON Sales Tax GmbH Wilhelmstraße 4 65185 Wiesbaden Telefon 49 611 94 58 50 90 Fax 49 611 94 58 50 95. You can also set a tax value for price. Send an email message requesting a refund of the sales tax to.

When a tax on goods or services is paid to a governing body directly by a consumer it is usually called a use tax. Get instant USA sales taxes simply by searching by zip code or state name. When buying supplies or materials that will be resold businesses can issue resale certificates to sellers and are not liable for sales tax.

Complete tax compliance in one-click. Apple will send you a check to refund the taxes. Falls Sie mit dem gekauften Produkt nicht zufrieden sind können Sie dieses gegen Vorlage der Originalquittung sowie der Originalverpackung innerhalb von vierzehn 14 Kalendertagen nach dem Kauf zurückbringen.