Bernie Sanders releases tax returns his income went from 314742 to 113 million in 8 years By John Whitesides Reuters Posted April 15 2019 730 pm. Nike is one of the biggest companies in the entire world and every single year they bring in billions of dollars worth of profitLike most big companies in.

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Each year estate and gift tax exemptions rise with inflation.

Bernie sanders taxes 13. The debate now with Republicans is whether or not we remain a democracy. Bernie Sanders I-VT were to become law Sanders says the Walton family the owners of Walmart would pay up to 858 billion more in taxes on their 2215 billion fortune. April 13 2021 Austin F DuBois.

Bernie wants Nike to pay more taxes. In this photo the progressive lawmaker speaks to reporters in the. We are glad he paid only 13 but we find the mind-numbing.

Bernie Sanders paid 134 federal income tax on over 200k income last year. 44K views May 13. Bernie Sanders Is Mostly Right About the SALT Deduction The state and local tax deduction overwhelmingly benefits rich households in high-tax states while shifting their federal tax.

New Bernie Sanders Legislation Seeks to Increase Taxes on Wealthy Estates. Sanders had about 393000 in book income last year and he and his wife reported giving nearly 19000 to charity. WASHINGTON Reuters - US.

A new analysis by Citizens for Tax Justice of presidential candidate Bernie Sanders recently released Medicare for All tax plan finds that Sanders health-related taxes would raise an estimated 13 trillion over 10 years. 58K views May 4. Their federal taxes came to 145840 for an effective federal tax rate of 26.

Bernie Breadlines Sanders who wants some of us to pay 90 of our income in taxes only paid 13 federal income tax. In 2016 and 2017 when Sanders also earned significant income from his books his effective tax rate was 35 percent and 30 percent respectively. Democratic presidential candidate Bernie Sanders and his wife paid 27653 in federal income taxes in 2014 an effective federal tax rate of.

Bernie Sanders I Vt proposed tax plan would raise taxes by 136 trillion over the next decade and reduce the economys size by 95 percent according to an. If so then the tax. Presidential candidate Sen.

He paid a 26 percent effective tax rate on that adjusted gross income. If a new estate tax bill introduced last Thursday by Sen. In 2018 Sanders adjusted gross income was 561293.

Bernie Sanders would narrowly dodge Biden tax hike Sanders made 350760 last year -- just below the 400000 limit proposed in Bidens tax hike. Democratic presidential candidate Bernie Sanders a senator famous for his campaign against the unjust power of the richest 1 released years of tax returns on Monday that showed he is now a millionaire himself. Senator Bernie Sanders I-Vermont accused Republicans of attempting to raise taxes on working families in a Saturday tweet.

I Vt proposed tax plan would raise taxes by 136 trillion over the next decade and reduce the economys size by 95 percent according to an analysis by the Tax Foundation. While on the campaign trail the senator has proposed 18 trillion in spending over the next decade. 172 Zeilen Did Sanders really only pay 134 in taxes last year.

WASHINGTON US. 59K views May 5. The family of Amazon Founder Jeff Bezos would pay up to 444 billion more in taxes on his 178 billion fortune.

The analysis also finds that the plan would raise average after-tax incomes for all but the top income groups. Big corporations steering clear of party conventions Jewish prime. Bernie Sanders Videos Tax Excessive CEO Pay.

Democratic presidential candidate Bernie Sanders and his wife paid 27653 in federal income taxes in 2014 an effective federal tax rate of 135 percent according to their tax return released on Friday by his campaign. Our government should fight for the working class. This year they have increased as usual but Senator Bernie Sanders has introduced legislation to reduce them drastically.

Sanders reported an adjusted gross income of nearly 561293 and paid 145840 a 26 effective rate in 2018 the documents show. Bernie Sanderss effective federal tax rate is rather low.

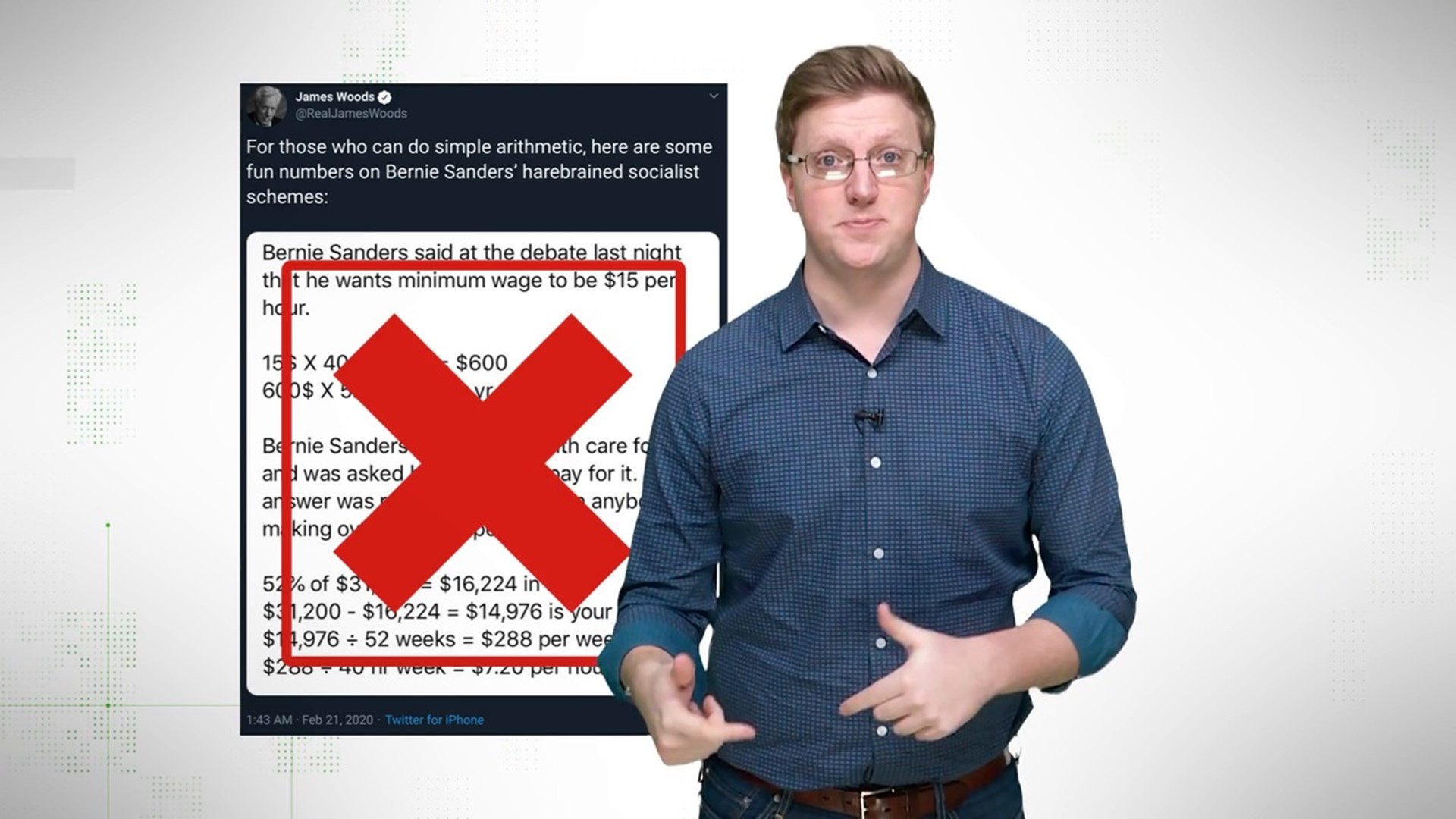

Verify Bernie Sanders Didn T Propose A 52 Tax Rate On Incomes Over 29 000 Wthr Com

Verify Bernie Sanders Didn T Propose A 52 Tax Rate On Incomes Over 29 000 Wthr Com

Sanders Lee And Tlaib Introduce Legislation To Tax Excessive Ceo Pay Accounting Today

Sanders Lee And Tlaib Introduce Legislation To Tax Excessive Ceo Pay Accounting Today

.png) How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Will Bernie Sanders Stick With A Carbon Tax

Will Bernie Sanders Stick With A Carbon Tax

Sanders Releases 10 Years Of Tax Returns Showing Income Bump From Campaign Book

Sanders Releases 10 Years Of Tax Returns Showing Income Bump From Campaign Book

Bernie Sanders Tax Returns Show Both Income And Tax Rate Jumped After Presidential Campaign Revealing Millionaire Status Abc News

Bernie Sanders Tax Returns Show Both Income And Tax Rate Jumped After Presidential Campaign Revealing Millionaire Status Abc News

Bernie Sanders Rolls Out Wealth Tax Plan That Would Help Fund Medicare For All Cnn Politics

Bernie Sanders Rolls Out Wealth Tax Plan That Would Help Fund Medicare For All Cnn Politics

How Much Billionaires Could Lose Under Sanders And Warren Wealth Taxes

How Much Billionaires Could Lose Under Sanders And Warren Wealth Taxes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.