Corporate bond is used as an alternative to the 10-year Treasury bill as an indicator of the interest rate. The first company on the AAA corporate bonds list is Automatic Data Processing symbol ADP.

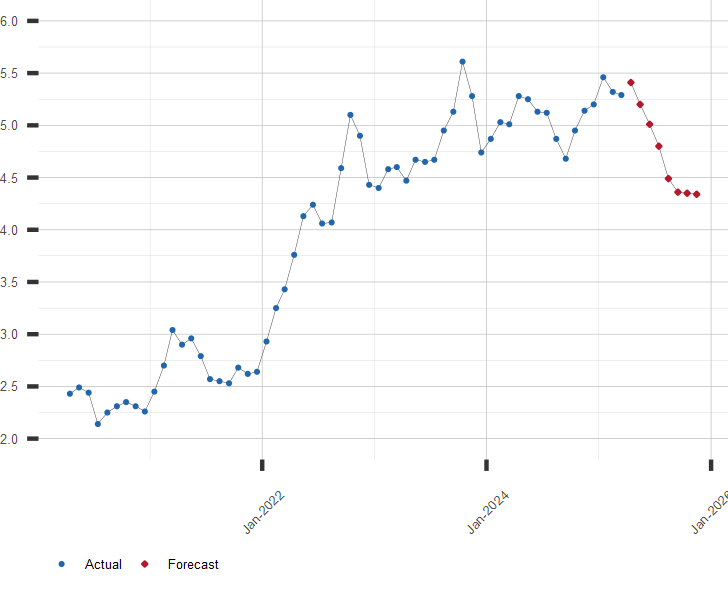

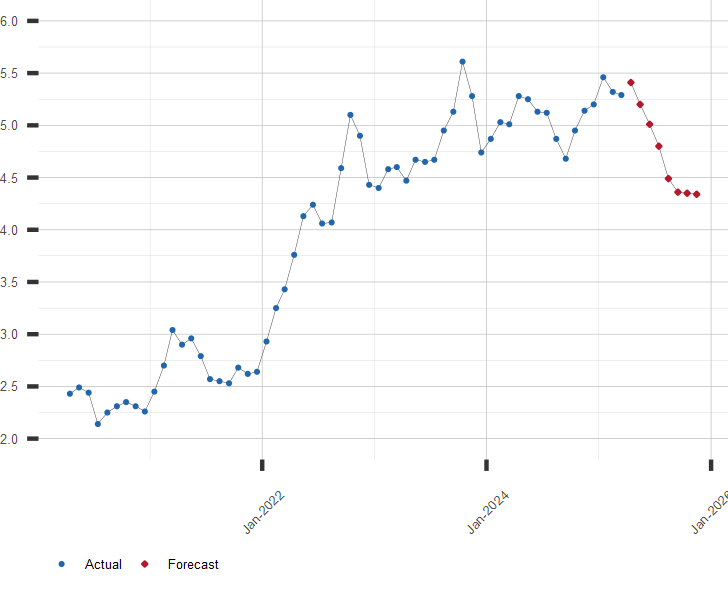

Aaa Corporate Bond Rate Forecast

Aaa Corporate Bond Rate Forecast

Yield curve modelling and a conceptual framework for estimating yield curves.

Aaa corporate bond rate. The HQM methodology projects yields beyond 30 years maturity out to 100 years maturity to get discount rates for long-dated pension liabilities. A long range forecast for Aaa corporate bond rate and similar series is available by subscription. USD Corporate Financials Bond AAA-AA-A Fund Passive PMC USDEUR Corporate Bond AAA-AA-A Fund Passive - GBP Currency Hedged.

Moodys Seasoned Aaa Corporate Bond Yield AAA Moodys Seasoned Aaa Corporate Bond Yield. Corporate bond funds are open ended debt mutual funds investing in highly rated corporate bonds. Another important way to analyze bond yields is spreads between different kinds of bonds.

During the financial crisis in 2008-2009 the spread between Aaa and Baa bonds widened because of the unpredictability of bonds and increased default rates. 304 Percent Monthly Updated. To begin even though these two companies are more highly rated than the US.

The second dataset contains all including AAA-rated euro area central government bonds. 1 Day NAV Change as of May 12 2021 -024 -043 NAV Total Return as of May 12 2021 YTD. On this page is an investment grade corporate bond return calculator which allows you to compute the total return of investment grade corporate bonds.

The index consists of up to 70 AAA rated corporate bonds that represent five distinct maturity buckets with up to 14 most liquid bonds within each maturity bucket. Evidence from the European Central Banks yield. Get Your Free Credit Report with Monthly Updates Check Now.

Fees as stated in the prospectus Expense Ratio. Triple-A AAA rated bonds are those deemed least likely to default. AAA AA and A Rated Corporate Bond Total Return Calculator.

NIFTY AAA Corporate Bond Index measures the performance of AAA rated corporate bonds across maturities. Please refer to the yield curve technical notes file for further technical details Monthly Bulletin article February 2008 Statistics Paper Series No 27. Aaa is the highest rating a corporate bond can get and is considered investment grade.

Treasuries it is important to keep a few issues in mind. Government Treasury bonds are historically considered the safest bonds. If your goal is to get highest fixed income then you can try for AAA rated company fixed deposit schemes.

Its based on the Bank of America Merrill Lynch US Corporate Master Index for corporate debt in the A to AAA range. In other words the AAA rating is as close to no-risk of default as you would get. NAV as of May 12 2021 5539.

Moodys Seasoned Aaa Corporate Bond Yield is at 301. HSBC Corporate Debt Funds can provide 8 to 11 returns Should you subscribe. IShares Aaa - A Rated Corporate Bond ETF.

This is an investment bond that acts as index of all the AAA-rated bonds by Moodys. When comparing the bonds of these corporations to US. Click here for more information or to subscribe.

Other Interest Rates Resources. In return for this safety the bonds return the lowest interest rate. The AAA Rating Isnt Everything.

As per SEBI guidelines corporate bond funds have to invest at least 80 of their total assets in AA and above rated corporate bonds. The HQM yield curve uses data from a set of high quality corporate bonds rated AAA AA or A that accurately represent the high quality corporate bond market. Bond-rating agencies take into account a companys balance sheet and many other factors.

Corporate bonds with the rating of AAA have seen a big increase in demand from investors in the recent economic turmoil and that makes the last four US companies with this rating a good investment choice for almost any investor. 1186 рядків Moodys Seasoned Aaa Corporate Bond Yield Historical Trend Chart 1919-01-01. Corporate Bond Rates Moodys Seasoned Aaa Corporate Bond Yield 291.

Government they also continue to offer higher yields since corporate bonds trade at a higher yield than government bonds. 304 more Updated. So AAA Corporate bonds are highest-rated corporate bonds out there.

In this article we would provide AAA rated companies that are offering highest fixed deposit rates up to 84 per annum.

Insight/2018/5.2018/05.02.2018_InflationLinkedBonds/Inflation%20linked%20bond%20market%20by%20country.png)