You need to have more than 25000 in your brokerage account. In order to help out newer traders Robinhood has a feature that tracks the number of day trades a trader has made in efforts to prevent traders from getting flagged as a pattern day trader.

Day Trading On Robinhood The Cans And Cannots

Day Trading On Robinhood The Cans And Cannots

You will then have five business days to meet the call by depositing cash.

How to get more day trades on robinhood. Buy 50 ABC Sell 15 ABC Sell 35 ABC. Under the SEC rules the minimum required account balance for day trading is 25000 especially if he plans to make four or more trades in a five-day period. You can increase your day trade limit by depositing more money but not by selling stock.

So when using the app as a first-time trader or even a seasoned trader youll always have a level of protection if youre worried about the PDT rule. This is two day trades because there are two changes in directions from buys to sells. But thats pretty unlikely.

This video will explain how to day trade on robinhood app in under 5 minutes. Assuming OP will need another 24000 to be able to get them based on his post. Heres how to get more day trades on Robinhood trading options as well as how to get FREE options contracts.

The other way to get around the 25000 rule is to downgrade to a Robinhood Cash account. Once youre marked you cant place day trades for 90 days unless you bring your account equity above 25000. The whole point of the rules is to stop the average Joe from burning his money blindly day trading penny stocks.

Accounts that place more than 3-day trades within 5 trading days will be marked for pattern day trading. Place more than three day trades within a five day trading period and Robinhood marks you as a pattern day trader PDT. Robinhood will give you a day trade call if you make a trade that is over your accounts limit.

My account reads now You have made four or more day trades within five trading days and have been marked as a Pattern Day Trader. Yes Robinhood can be used for day trading but with a few restrictions. This isnt just a Robinhood limitation it applies to every brokerage in the US.

But with day traders on Robinhood there are exceptions. This rule isnt specific to Robinhood but if you have a small account it can affect your trading. First you still have to keep the pattern day trading PDT rule in mind.

So if anything they would get more strict in that scenario. The robinhood app has several advantages for day traders so well examine all. Pattern Day Trading Rule.

This means that you are no longer allowed to make a day trade for 90 days or until your account is over 25k. Find the stock youll include in your options trading. Navigate to the upper-right part of your screen and press the magnifying glass.

Due to federal regulations you are now restricted from making day trades for 90 days. After that you are marked a pattern day trader. If those trades equal less than 6 of the total trades within your margin account theres no problem.

Click or tap the stocks name. If you have less than 25k in your account you are allowed 3 day trades within 5 trading days. So what counts as a day trade.

Buy 10 ABC Sell 10 ABC. You can then start placing your options trades. Portfolios valued at more than 25000 are not necessarily subjected to the same Robinhood day trade limit.

I was able to purchase shares today. Thats not the case. This rule limits traders to no more than three day trades within a rolling five-day trading period.

Once he complies with this he is qualified to become a pattern day trader PDT. However for those portfolios that fluctuate and fall below 25000 its important to adhere to this Robinhood day trading rule. Receiving a Day Trade Call.

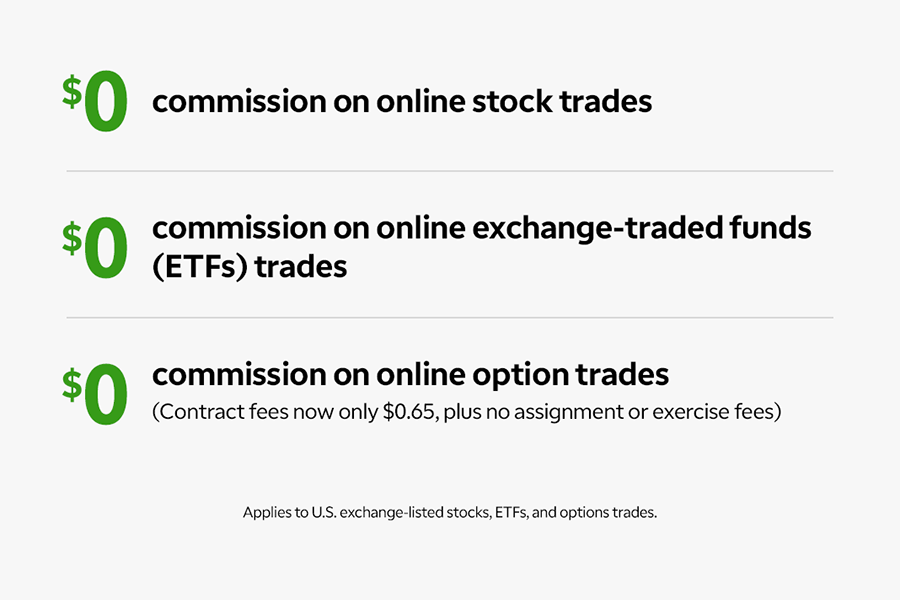

Press the Trade button in the lower-right part of your stocks Detail section. Last time Robinhood mysteriously asked me to not talk about it which was strange seeing as a they werent being hacked so their own security wasnt at risk b everyone willing to talk to me had already be compromised some had even already been made whole by Robinhood and c letting people know what is happening and how can prevent more of their own customers from being hacked. Zero commission apps like Robinhood attract said average Joes.

You can still make trades just no more day trades. Works especially great in times of increased vo.