Captive insurance companies are independent subsidiaries that a parent company creates and manages to underwrite its financial risks along with those of its affiliates. Captive insurance company - Deutsch-Übersetzung Linguee Wörterbuch.

What You Need To Know About Captive Insurance

What You Need To Know About Captive Insurance

Captive Insurance Solutions NZ Ltd Specialists in Alternative Risk Transfer solutions members of the New Zealand Captive Insurance Association NZCIA Going above for.

Captive insurance co. As we enter 2020 however captives are enjoying a resurgence as a growing solution for businesses of all sizes trying to think outside the box. The goal of this type of insurance is that it insures the risks of the owners. What Is Captive Insurance.

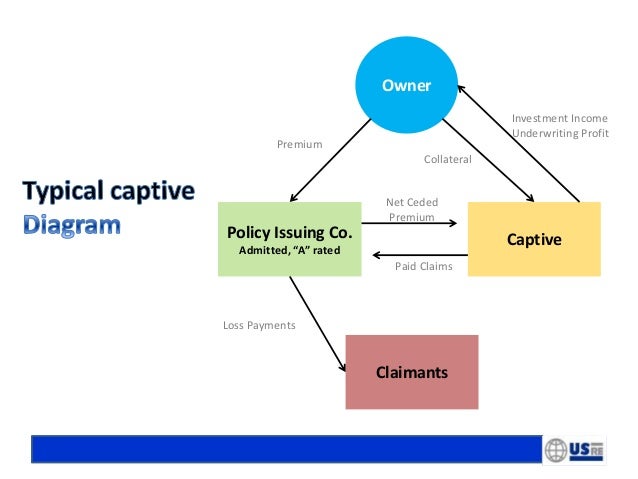

A captive insurance company is a wholly-owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. Captive insurance is a risk management tool with tax benefit and increased company Cash Flow. It is a type of self-insurance.

The first active captive insurance company in the United States was started in Ohio by Fred Reiss who in 1953 founded Steel Insurance Company of America for Youngstown Sheet Tube Company in Ohio. Captives made their debut in the US. Rent-a-captives mitigate capital outlays but typically require long-term participation to make it worth the while.

Captive insurance is structured in a way where the insurance company which issues policies is wholly-owned and controlled by those it insures. Micro means it takes in less than 23 million in premiums. Group captive insurance formed by a group of companies to take insurance for their collective risk.

Those who are insured are able to benefit from the underwriting profits that are collected. Got questions about captive insurance. Viele übersetzte Beispielsätze mit captive insurance company Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.

Captive insurance is insurance or reinsurance provided by a company that is formed primarily to cover the assets and risks of its parent company or companies. They offer companies greater flexibility to retain risk and insurancereinsurance options to manage a hard insurance market. A pure captive insurance company is established by parent organization to provide insurance to itself or subsidiaries.

These companies are owned and managed solely by and for the benefit of the parent company. In the late 1950s. Capitalization and commitment - Establishing a captive insurance company requires a substantial amount of initial capital to ensure that the captive remains financially healthy during tumultuous times.

Its primary purpose is to insure the risks of its owners and its insureds benefit from the captive insurers underwriting profits. A captive is an insurance company created and controlled by a business that is not an insurer for the purpose of insuring that companys risks. It is essentially an in-house insurance company with a limited purpose and is.

Captive insurance programs have been popular among business largest corporations since they were first created in the 1950s. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds. Simplistically a captive is an insurance company that is owned by the insured or related parties.

Reiss drew the term captive from the steel companys captive mines which were sending ore back to the companys mills. Captives allow businesses to maintain direct control of their insurance programs. Captive Insurance jest firmą ubezpieczeniową należącą do jednego podmiotu gospodarczego grupy zawodowej lub grupy firm powiązanychNazwa Captive Insurance jest używana dla specyficznych zakładów ubezpieczeń których głównym celem działalności jest zabezpieczenie ryzyk nieubezpieczalnych na rynku tradycyjnym oraz właścicielom captiveu.

There are three types of captive insurance companies. Captive insurance companies came into existence because of difficult markets like the one were experiencing now.