Biden unveils reversal of Trumps tax cuts for the most wealthy Mr Joe Biden will use his speech to a joint session of Congress to unveil the US18 trillion S23 trillion. Those making between 500000 and 1 million will pay 208.

Placing Joe Biden S Tax Increases In Historical Context

Placing Joe Biden S Tax Increases In Historical Context

President Biden who is seeking to increase taxes on corporations and the super-rich is not about to let Republicans claim the mantle of tax cuts.

Biden tax cuts. His core tax proposals will increase taxes on people earning more than 400000 per. Joe Biden Claims Nearly All Trump Tax Cuts Went To The Wealthy 21876 AP PhotoPatrick Semansky. During the first solo news conference of his presidency on Thursday Biden griped about Republicans opposition to the stimulus bill spending saying that they supported a massive tax cut.

The cuts which have largely already come in the form of stimulus checks will also play out in the 3000-plus Child Tax Credit and expansion of the. The tax cuts in President Bidens American Rescue Plan ARP are among the biggest one-year tax reductions. A Last-Minute Add to Stimulus Bill Could Restrict State Tax Cuts Republicans say Congress is infringing on state sovereignty by trying to limit the ability of local governments to control their.

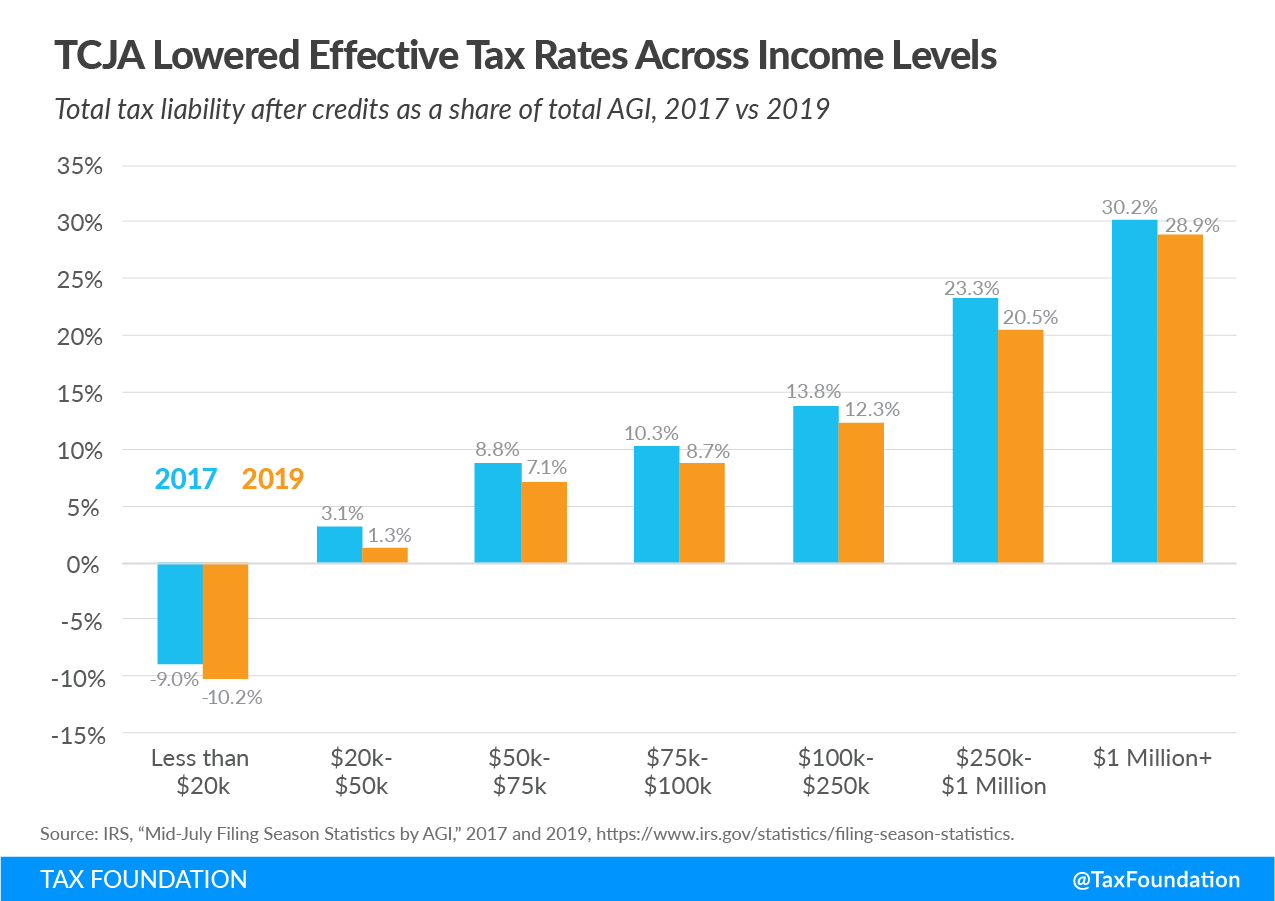

At his first press conference since taking office President Joe Biden claimed that 83 percent of Donald Trumps 2017 tax cut went to the top 1 one percent of earners. Republicans have claimed that 82 of Americans would see. But the TCJA still resulted in tax cuts for the vast majority of people across the board and a staggering 82 of middle-class earners received a tax cut that averaged to more than 1000.

The Biden administration wants to require households earning more than 1 million to pay ordinary income tax rates on their capital gains. President Joe Biden made a false claim regarding former President Donald Trumps tax cuts in an effort to further socioeconomic division. They have plans to eliminate the Trump tax cuts and raise personal tax rates by 25 capital gains taxes by 60 and corporate taxes by 33.

Democrats have spent years promising to repeal the 2017 Tax Cuts and Jobs Act which Republicans passed without a single Democratic vote and was estimated to cost nearly 2 trillion over a. Im announcing today. High earners excluded from Democrats tax cuts would see their average tax burdens essentially unchanged from 2019.

Biden has said no taxpayer making less than 400000 a year would see a tax increase under his plan. The top rate now is about 24 percent. A new nonpartisan government report states that the American Rescue Plan the bill signed into law by President Biden in March delivered a large tax cut.

John Carney 25 Mar 2021. The Biden administration is exploring tax cuts that mostly benefit wealthier Americans as congressional Democrats home in on restoring the breaks for their relatively well-heeled constituents. He said on Monday.

Bidens families plan which provides universal free pre-K and community college and implements national paid family leave wont nix a business tax deduction included in the 2017 Tax Cuts and Jobs Act TCJA CNBC reportedThe provision allows owners of pass-through entities which are often small businesses to deduct 20 of their share of the business income from their tax filing. The beneficiaries of the 2017 tax reforms were not confined to the. President Joe Biden campaigned on a promise to raise taxes on wealthy Americans and corporations.

Bidens cuts for lower-income and middle-class households The relief law is projected to reduce federal taxes by an average of 3000 per household in. Talk about playing against type.