Please visit our Tracking John Rogers Ariel Investments Portfolio series to get an idea of their investment philosophy and the funds moves during Q4 2019. The Company maintains assets for individual and institutional clients in.

Monitoring John Rogers Ariel Investments Portfolio This Autumn 2020 Replace Mutf Argfx Lupa Express

Monitoring John Rogers Ariel Investments Portfolio This Autumn 2020 Replace Mutf Argfx Lupa Express

139 rows Positions held by Ariel Investments consolidated in one spreadsheet with up to 7 years of.

Ariel investments portfolio. Retirement planning college planning and our step by step investment guide Investing 101 can all be found here. Stock Company Name of Portfolio Shares Value Change Change Ownership History Price History Date. Top Holdings Largest Trades Portfolio Structure Sector Allocation Performance History.

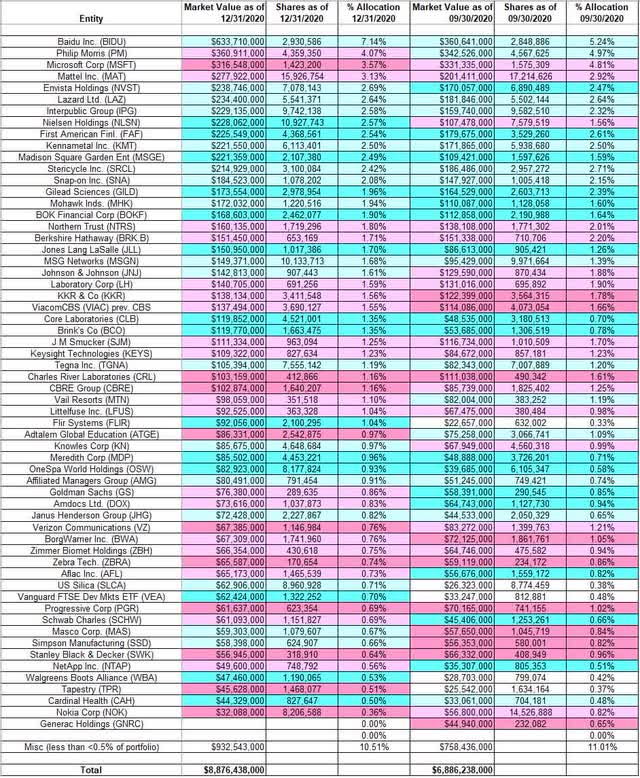

Ariel Investments 13F annual report Ariel Investments is an investment fund managing more than 888 billion ran by James Prescott. Ariel Investments 57 billion equity portfolio which is composed of 149 stocks is largely invested in the financial services 192 communication services 1483 and health care 1435. Ariel Investments 13F annual report Ariel Investments is an investment fund managing more than 888 billion ran by James Prescott.

Stock market has performed erratically in 2014. - By Margaret Moran. There are currently 140 companies in Mr.

About Rupal Bhansali is the chief investment officer portfolio manager of Ariels multi-billion dollar international global equity portfolios. Our site contains detailed fund descriptions and information to help you make the right investments for your future. For instance both the SP 500 and the Russell 2000 fell more than 25 in January but recovered to gain more than 45 in February.

Chairman CEO Chief Investment Officer Lead Portfolio Manager Ariel Small and SmallMid Cap Value Products and Ariel Fund Co-Portfolio Manager Ariel Mid Cap Value Product and Ariel Appreciation Fund Johns passion for investing started when he was 12 years old when his father bought him stocks every birthday and every. Ariel Investments Funds Ariel Investments is a company that sells mutual funds with 5469M in assets under management. The largest investments include Baidu Inc-sp Adr and Philip.

Ariel Investments recently disclosed its portfolio updates for the third quarter of 2020 which ended on Sept. In 2008 John was awarded Princeton Universitys highest honor. The average expense ratio from all mutual funds is 095.

Rogers launched Ariel Investments in 1983 after working as a stockbroker for 25 years at William Blair Company LLC. Ariel Investments is managed by founder John W. 10000 of all the mutual funds are no load funds.

Ariel Investments Holdings Heatmap. Ariel Investments LLC Ariel Investments LLC operates as an investment company. Their flag ship mutual fund is the.

The average manager tenure for all managers at Ariel Investments is 1648 years. Ariel Investments has met the qualifications for inclusion in our WhaleScore systemWhalewisdom has at least 87 13F filings and 878 13G filings Their last reported 13F filing for Q4 2020 included 8876438000 in managed 13F securities and a top 10 holdings concentration of 3347. Contributions to this individual fund portfolio will be invested solely in the Ariel Fund.

Ariel Investments portfolio commentary for the month ended May 2014. The largest investments include Baidu Inc-sp Adr and Philip. The Fact Sheet Prospectus and Annual.

Start browsing stocks funds and ETFs and more asset classes. Before making contributions to this portfolio you should consider the more detailed information about the underlying fund in which it invests including its investment objectives and policies risks and expenses contained in the links below. There are currently 140 companies in Mr.

Ariel Investments 13F portfolio value increased from 689B to 888B this quarter. The Ariel Mutual Funds are a no load family of mutual funds. Largest Stock Buys.

The oldest fund launched was in 1986. Before making contributions to this portfolio you should consider the more detailed information about the underlying fund in which it invests including its investment objectives and policies risks and expenses contained in the links below. Contributions to this individual fund portfolio will be invested solely in the Ariel Fund Instl.

Top 50 Ariel Investments Holdings.