Were so boring when it comes to investing and retirement. A Target Retirement fund is a ready-made portfolio that makes investing for retirement simple.

Jpmorgan Smartretirement 2040 Fund R2 J P Morgan Asset Management

Jpmorgan Smartretirement 2040 Fund R2 J P Morgan Asset Management

Invests in a diversified portfolio of other T.

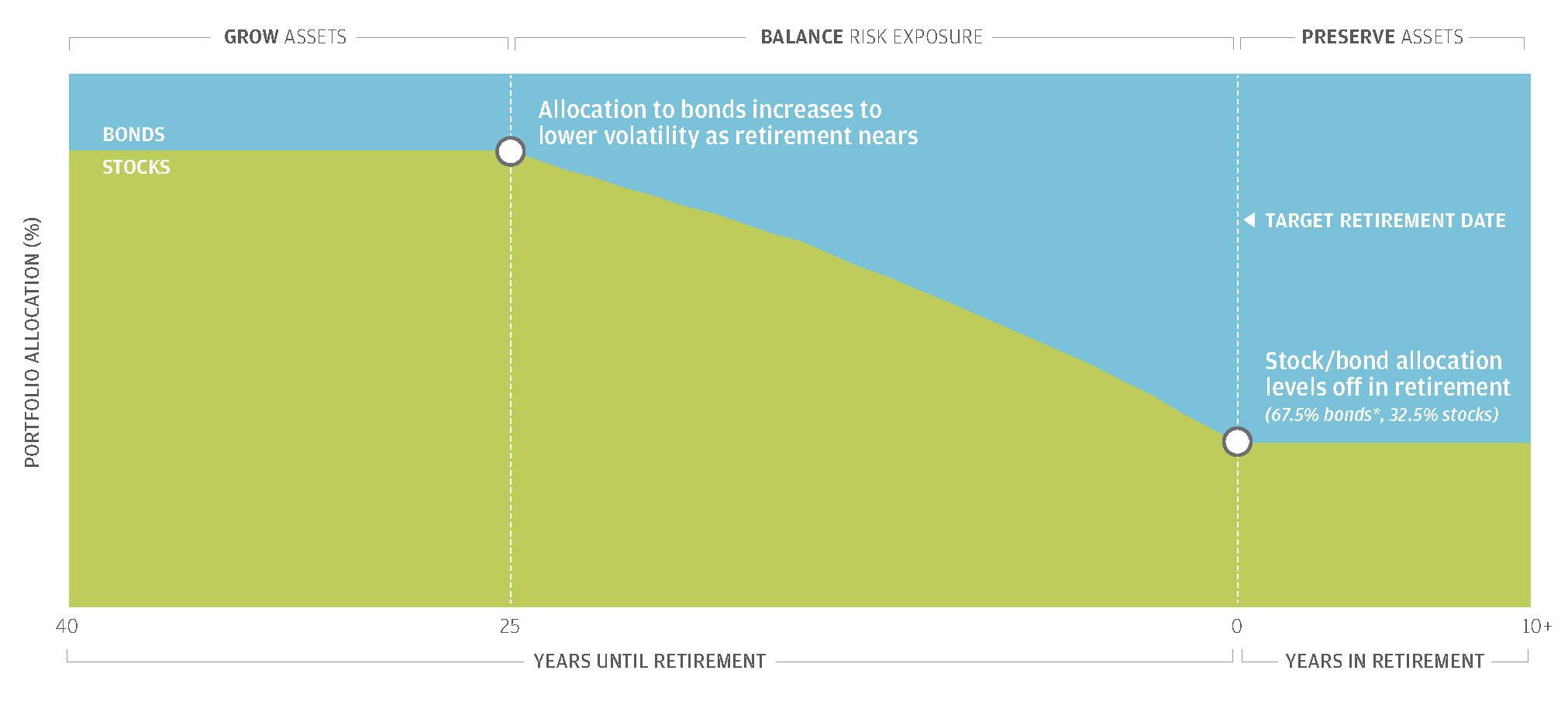

Target retirement 2040 fund. Vanguard Target Retirement 2040 Fund VFORX. How to invest successfully for retirement. For an investor planning to retire at age 65 in 2040 for example the target allocation for the Schwab Target 2040 Index Fund will be approximately 40 equity 56 fixed income and 4 cash and cash investments including money market funds.

Natixis Sustainable Future 2040 Fund. Rowe Price stock and bond funds will change over time in relation to its target retirement date. Ensures a disciplined approach to asset allocation with strategic forecasts and.

Nationwide Destination 2040 Fund. Key Features Seeks to manage key risks that investors face over time which include shortfall longevity volatility and inflation. Benchmark Overall Morningstar Rating Morningstar Return Morningstar Risk Morningstar Lifetime Mod 2040 TR USD QQQQ Above Average Average Out of 197 Target-Date 2040 investments.

The fund invests primarily in shares of other registered investment companies the underlying funds according to an asset allocation strategy developed by Madison for investors planning to retire in or within a few years of 2040. The funds allocation between T. We do the vast majority of our retirement investing through one single fund.

The funds allocation between T. Retirement Goal 2040 Fund Prudential Retirement Separate Accounts - Target Date Fund First Quarter 2020 Fund Fact Sheet Key Facts Investment Advisor Prudential Retirement Insurance and Annuity Company PRIAC Asset Class Allocation - Target-Date 2040 Primary Index Retirement Goal 2040 Primary Benchmark Net Assets 841 Million Inception Date 11252002. But I think boring is good.

The Vanguard Target Retirement 2040 Funds stated objective is to provide capital appreciation and current income consistent with its current asset allocation It provides broad diversification. The Vanguard Target Retirement 2040 Fund Like other Vanguard target-date funds this fund invests in four Vanguard index funds with asset allocations of about 85 in equities and 15 in corporate. Each of the Target Retirement Funds invests in Vanguards broadest index funds giving you access to thousands of US.

You simply choose a fund based on when you plan to retire and we do the rest. Target 2040 Fund. View mutual fund news mutual fund market and mutual fund interest rates.

Rowe Price stock and bond funds will change over time in relation to its target retirement date. TRRDX CUSIP 74149P408 Factsheet Fund Story Prospectus. Over time the funds asset allocation will become more conservative until it reaches approximately 10-30 in stock funds and 70-90 in bond funds.

Retirement 2040 Broad Index. An investments overall Morningstar Rating based on its risk-adjusted return is a. Here are the best Target-Date 2040 funds.

The fund will continue to increase its allocation to fixed income until the year 2060. Our goal every year will be to max out those last two accounts using this one fund. And international stocks and bonds including exposure to the major market sectors and segments.

TARGET RETIREMENT 2040 FUND Quarter Ending September 30 2019 WG FCT919 Additional Information About Risk The Fund is subject to the risks associated with the stock and bond markets any of which could cause an investor to lose money. VFORX A complete Vanguard Target Retirement 2040 FundInvestor mutual fund overview by MarketWatch. Vanguard Target Retirement Funds give you a straightforward approach to a sophisticated problem.

Each Target Retirement fund aims to balance taking the risks needed to grow your wealth while also taking steps to preserve your retirement savings. We invest in this fund within my Rollover IRA my old 401K our Roth IRAs and in my new Solo 401K. Less risk through broader diversification.

Rowe Price Retirement 2040 Fund. The investment objective of the State Street Target Retirement 2040 Fund is to seek capital growth and income over the long term. Voya Index Solution 2040 Port.

A target-date fund operates under an asset allocation formula that assumes you will retire in a certain year and adjusts its asset allocation model as it gets closer to that year. Target Retirement 2040 Fund. Find the latest Vanguard Target Retirement 2040 VFORX stock quote history news and other vital information to help you with your stock trading and investing.

Rowe Price stock and bond funds that represent various asset classes and sectors. Each fund is designed to help manage risk while trying to grow your retirement savings.