Trade or exchange cryptocurrency including the disposal of one cryptocurrency for another cryptocurrency. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax.

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax.

Capital gains tax crypto. Depending on how much money you make in. 5 Zeilen Short-Term vs Long-Term Crypto Capital Gains. Capital Gains and Losses for Crypto.

You pay Capital Gains Tax when your gains from selling certain assets go over the. The idea of an 80 crypto capital gains tax has some investors in digital assets worried. A capital gains tax CGT event occurs when you dispose of your cryptocurrency.

Two months later he traded 05 of this bitcoin for 15 ETH. Long-term capital gains are often taxed at more favorable rates than short-term capital gains. Your capital gains and losses each get reported one-by-one onto Form 8949.

Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. Capital gains tax does not exist in Singapore so neither individuals nor corporations holding cryptocurrency are liable. If you hold a crypto investment for at least one year before selling your gains qualify for the preferential long-term capital gains rate.

If you invested 50000 into cryptocurrency and made 1000000 on your investment firstly congratulations. Sell or gift cryptocurrency. The creation trade and use of cryptocurrency is rapidly evolving.

Under existing legislation cryptocurrency is considered to be a capital asset and capital gains tax rules apply on the disposal of these assets. Losses If your crypto is a capital asset under the definition above you can use a capital loss on that asset to offset capital gains from other assets for that tax year plus 3000. If youre unsure which of your crypto transactions qualify as taxable checkout our crypto tax guide.

A disposal can occur when you. Thats been clear by. Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency.

Then theres that 80 crypto capital gains tax rumor to account for. Your capital gains and losses from your crypto trades get reported on IRS Form 8949. 13 Capital Gains Tax and Corporation Tax on Chargeable gains If a profit or loss on a currency contract is not within trading profits it would normally be taxable as a chargeable gain or allowable as a loss for CT or CGT purposes.

That means it is subject to capital gains tax which has a much better tax. For many countries including the USA Canada Australia and parts of Europe cryptocurrency transactions are uniquely subject to capital gains tax and the onerous reporting requirements that. Gains and losses incurred on cryptocurrencies are chargeable or allowable for CGT if they accrue to an.

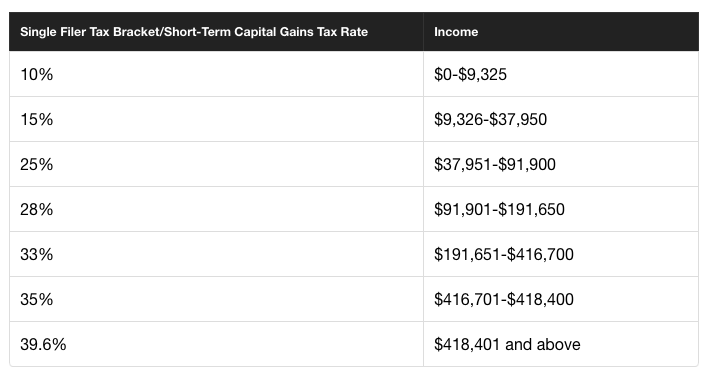

Your specific tax rate primarily depends on three factors. Youre correct that cryptocurrency is not a form of moneycurrency for tax purposes. The federal tax rate on cryptocurrency capital gains ranges from 0 to 37.

This is called the taxable capital gain. Less than one year. But companies based in Singapore are liable to income tax if their core business is cryptocurrency trading or if they accept cryptocurrency as payment.

Cryptocurrency is considered a digital asset in the CRAs eyes. Other capital assets include things like stocks and bonds. This information is our current view of the income tax implications of common transactions involving cryptocurrency.

Mitchell purchased 1 bitcoin for 10000 on July 1.