The Canadian and US stock markets have some similarities. A number of exchange traded funds ETFs are available to Canadian investors on the TSX with exposure to blue-chip firms.

/health_insurance_istock_36091054_small-5bfc3b1b4cedfd0026c53048.jpg) Best Healthcare Etfs For Q3 2021

Best Healthcare Etfs For Q3 2021

For investors looking for dividend income along with growth the ETF which.

Healthcare etf canada. It invests in Index Shares underlying the SPTSX Canadian REIT Index in the. With rapid advancements in the pharmaceutical industry and medical technology balance sheets remain healthy in the healthcare sector. The Vanguard Health Care ETF VHT is next in popularity with over 13 billion in assets.

The fund is still market cap weighted though so a. The fund seeks to track the MSCI US Investable Market Health Care 2550 Index. First Trust AMEX Biotechnology.

Bei 4 Anbietern davon ist der ETF aktuell kostenfrei im Sparplan erhältlich. It has a significant portfolio of assets and a high dividend yield. Der ETF ist VL-fähig.

Healthcare ETFs invest in stocks of companies involved in the healthcare industry. Dollar version that trades as HHLU and yields 88 per cent. Health-ETFs und -Fonds überdurchschnittlich robust in Krisen.

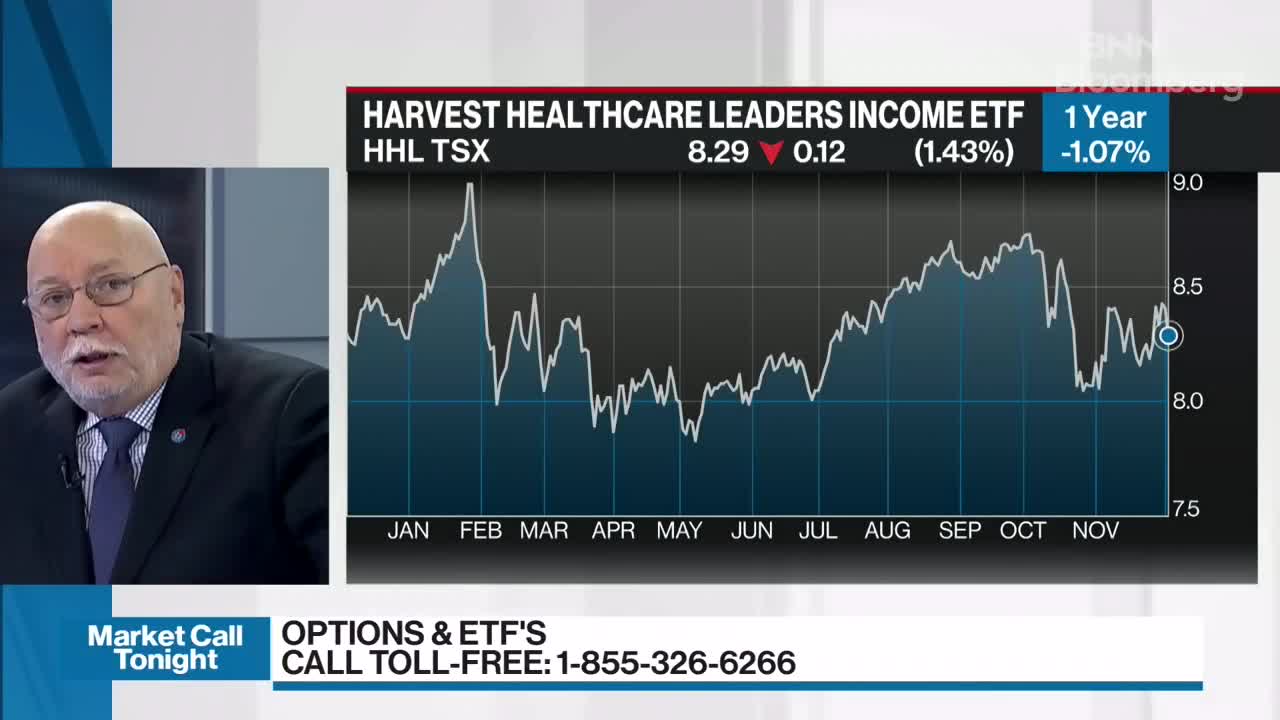

Harvest Healthcare Leaders Income ETF is an equally weighted portfolio of 20 large-cap global Healthcare companies selected for their potential to provide attractive monthly income and long-term growth. ETFs are not guaranteed their values change frequently and past performance may not be repeated. Both for example boast with lots of gigantic financial services companies but because of Canadas vast natural resources the Toronto Stock Exchange tends to be home to a lot more energy mining and mineral stocks whereas the New York Stock Exchanges home to many more a much technology and healthcare companies.

This unique ETF invests in top global healthcare companies with the added value of a covered call strategy applied on up to 33. With over 430 holdings this ETF provides broader diversification and comparatively more mid- and small-cap exposure than XLV above. Es gibt nämlich auch Aktien die traditionell relativ gut durch Krisen kommen.

It pays monthly distributions of 00583 about 070 per year to yield 87 per cent at the current price. Top HealthcareBiotech ETFs as of 33121. A number of exchange traded funds ETFs are available to Canadian investors on the TSX with exposure to blue-chip firms.

Why Invest In This Fund. Die Mindestsparrate beträgt 1. Die Gesundheitsbranche gehört zu den vergleichsweise stabilen Sektoren.

For investors looking for dividend income along with growth the ETF which is probably the best option for such investors is the Harvest Healthcare Leaders Income ETF TSXHHL. These companies include biotech pharmaceuticals hospitals medical device makers and more. XRE is a Canadian REIT ETF established in Canada that seeks to provide investors with long-term capital growth through replicating the performance of the SPTSX Capped REIT Index net of expenses.

In order to generate an enhanced monthly distribution yield an active covered call strategy is engaged. Healthcare exchange-traded funds ETFs invest in a basket of stocks of companies that provide medical services develop medical equipment or drugs offer medical insurance or. The ETF provides exposure for investors to stocks in multiple healthcare industries including biotechnology healthcare equipment and supplies healthcare providers and services healthcare.

Click on the tabs below to see more information on Healthcare ETFs including historical performance dividends holdings expense ratios technical indicators. There is also a US. Wenn es an der Börse knallt wie in der Corona-Krise dann suchen Anlegerinnen Sicherheit und das nicht nur bei Gold und Bundesanleihen.

The only Canadian-based fund in this sector that offers decent cash flow is the Harvest Healthcare Leaders Income ETF TSX. Vanguard ETFs are managed by Vanguard Investments Canada Inc an indirect wholly-owned subsidiary of The Vanguard Group Inc and are available across Canada through registered dealers. 351 King Street East Suite 1600 Toronto ON Canada M5A 0N1.

Der iShares Healthcare Innovation UCITS ETF ist bei insgesamt 15 Online Brokern sparplanfähig.