Percent Monthly Not Seasonally Adjusted Jan 1984 to Mar 2021 Apr 15 505-Year High Quality Market HQM Corporate Bond Spot Rate. Another important way to analyze bond yields is spreads between different kinds of bonds.

Corporate Debt Bubble Wikipedia

Corporate Debt Bubble Wikipedia

Federal Provincial and Corporate Bonds.

Highest corporate bond rates. Investors who want to invest money for longer duration but prefer less riskier. Companies sit at 208 compared with the 10-year Treasury which. Federated Hermes High-Yield Strat Port.

These mutual funds invest in highest rated bonds issued by corporatescompanies. SEI High Yield Bond SIIT Fund. Issuer Coupon Maturity Issuer Type DBRS D B R S Rating Offer Price Semi-Annual Yield to Maturity.

Here are the best Corporate Bond ETFs. Percent Monthly Not Seasonally Adjusted Jan 1984 to Mar 2021 Apr 15 80-Year High Quality Market HQM Corporate Bond Spot Rate. HQM Corporate Bond Yield Curve Spot Rates.

MAN M A N. Here are the best High Yield Bond funds. Over 150 of the most popular corporate bonds and gilts can be bought in a Vantage Account for just 595 to 1195 per deal online.

Aaa is the highest rating a corporate bond can get and is considered investment grade. HQM Corporate Bond Yield Curve Spot Rates. 01-Sep-29 September 1 2029.

Get all the information on the bond market. Retail Charity Bonds - Hightown. SPDR Portfolio Corporate Bond ETF.

2016 Posted by Randy. You can also use the search tool to find the right bond yield and bond rates. ProShares UltraPro QQQ ETF has high liquidity and trades over 12 million shares per day.

Graph and download economic data for 10-Year High Quality Market HQM Corporate Bond Spot Rate HQMCB10YR from Jan 1984 to Mar 2021 about 10-year bonds corporate interest rate interest rate and USA. 6 yrs 7 mths. IShares 5-10 Year invmt Grd Corp Bd ETF.

Current State of Bond Rates. 05-Sep-25 September 5 2025. Bond Inventory Highlights.

RBC BlueBay High Yield Bond Fund. Corporate Bond Fund. Find the latest bond prices and news.

HQM Corporate Bond Yield Curve Par Yields. Goldman Sachs Acss Invmt Grd Corp Bd ETF. ONT O N T.

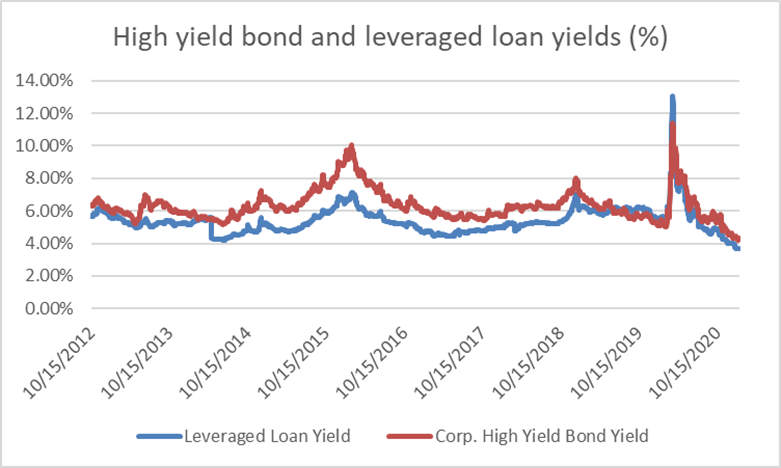

United Utilit Water Ltd. The best-performing high-yield corporate bond fund based on performance over the past year is the Metropolitan West High Yield Bond Fund MWHYX. During the financial crisis in 2008-2009 the spread between Aaa and Baa bonds widened because of the unpredictability of bonds and increased default rates.

Although bond rates have fallen in 2020 interest rates on 7- to 10-year bonds of high-quality US. Argentina Bond Emerging Markets Bond South American Bond Short Term High Yielding Bond Sinking Bond US Dollar Bond 57 Yields in AUD bonds from AXA BBBBaa1A rated First Call in Oct. 6 yrs 6 mths.

It has an AUM of 8877 million and a 1-year return rate of 9415 a 3-year return rate of 22258 and a. Schwab 5-10 Year Corp Bd ETF. 6 yrs 5 mths.

223 rows Corporate Bond Weighted Average Interest Rate CB Wtd Avg. Loomis Sayles High Income Opps Fund. Learn more about the corporate bond yield curve and how it relates to the Pension Protection Act by downloading these papers and historical data.

Retail Charity Bonds - Golden Lane.

Corporate Bonds Start 2019 With Strong Performance Morningstar

Corporate Bonds Start 2019 With Strong Performance Morningstar

Your Complete Guide To Corporate Bonds The Motley Fool

Your Complete Guide To Corporate Bonds The Motley Fool

Pandemic Sends Real Yields On Corporate Debt Into Negative Territory Financial Times

Pandemic Sends Real Yields On Corporate Debt Into Negative Territory Financial Times

Corporate Bonds At Second Widest Level In 20 Years Morningstar

Corporate Bonds At Second Widest Level In 20 Years Morningstar

Corporate Bond Market Dysfunction During Covid 19 And Lessons From The Fed S Response

Corporate Bond Market Dysfunction During Covid 19 And Lessons From The Fed S Response

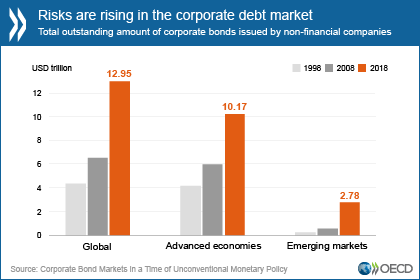

Risks Rising In Corporate Debt Market Oecd

Risks Rising In Corporate Debt Market Oecd

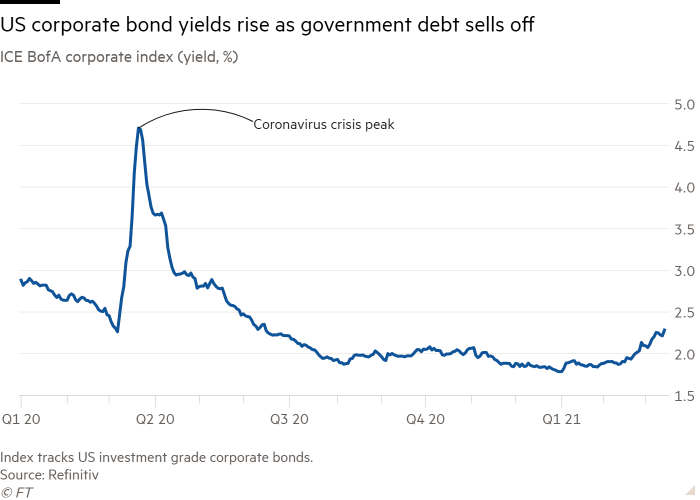

Treasury Sell Off Sweeps In To Us Corporate Bond Market Financial Times

Treasury Sell Off Sweeps In To Us Corporate Bond Market Financial Times

Your Complete Guide To Corporate Bonds The Motley Fool

Your Complete Guide To Corporate Bonds The Motley Fool

Corporate Bonds At Second Widest Level In 20 Years Morningstar

Corporate Bonds At Second Widest Level In 20 Years Morningstar

Us Corporate Bonds Grow More Susceptible To Sudden Rise In Rates Financial Times

Us Corporate Bonds Grow More Susceptible To Sudden Rise In Rates Financial Times

Corporate Debt Bubble Wikipedia

Corporate Debt Bubble Wikipedia

Risks In The Bbb Corporate Bond Market Institutional Blackrock

Risks In The Bbb Corporate Bond Market Institutional Blackrock

2021 Bond Market Outlook Seeking Alpha

2021 Bond Market Outlook Seeking Alpha

Education In Times Of Financial Stress What Typically Happens To The Difference Between Interest Rates On Corporate Bonds And U S Treasury Bonds

Education In Times Of Financial Stress What Typically Happens To The Difference Between Interest Rates On Corporate Bonds And U S Treasury Bonds

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.