RBC Index Funds. Plenty of investment options.

Above Index Returns How To Beat The Index Ed Rempel

Above Index Returns How To Beat The Index Ed Rempel

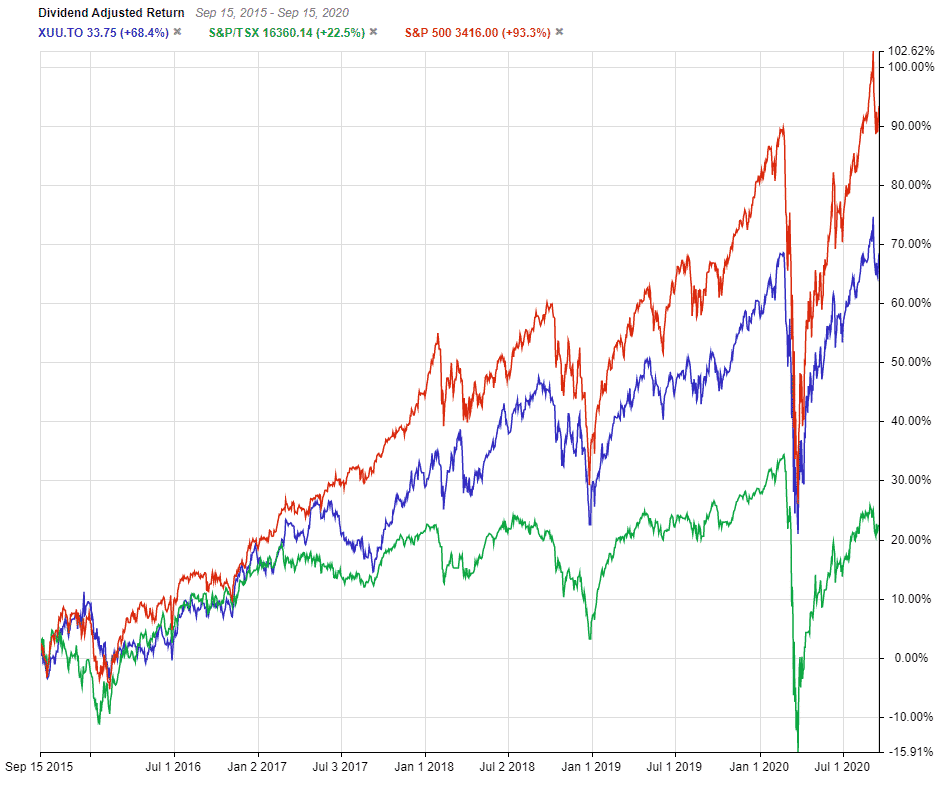

This is done through the purchase of Canadian exchange-traded funds ETFs or mutual funds that are built to closely track the underlying index.

Index funds canada. ZAG has been around since January 2010 and has delivered annual returns of 377. Vanguard FTSE Canada All Cap Index ETF. They track the same indices.

Claymore Investments also offers a series of ETFs available in Canada Claymore has been acquired by BlackRock - iShares Canada so please refer to iShares Canada for any of these funds. Not all markets and not all index funds are created equal. Company growth stocks by market capitalization.

A Canadian Index ETF is a fund that invests largely in Canadian equities by tracking a major Canadian stock index. RBC Canadian Bond Index Fund RBF700. It brought forth the concept of Jack Bogle founder of Vanguard Investments.

While there are an abundance of great ETFs available that fit the bill here are my top 5 picks for 2020. TD International Index Fund e TDB911 The TDB911 has a comparatively low MER at 045 and has an objective for long-term growth by tracking the international market indexes for Europe Asia and Far East region keying in on large well-established companies. This means that an index fund effectively matches the performance of that index.

The largest bond ETF in Canada is BMOs Aggregate Bond Index ETF Ticker. RBC International Index Currency Neutral Fund RBF559. Its designed to track the FTSE TMX Canada UniverseXM Bond Index holding a mix of federal provincial and corporate bonds at both short- and long-term durations.

An index fund is a type of mutual fund thats designed to passively track a specific stock market index such as the SPTSX Composite Index the benchmark Canadian index or the SP 500 Index in the United States. They are a low-risk investment that lets you share risk across an entire index rather than focusing on a handful of stocks. Another benefit is the fact that index funds allow investors to participate in the long-term growth potential of a particular stock market with a caveat.

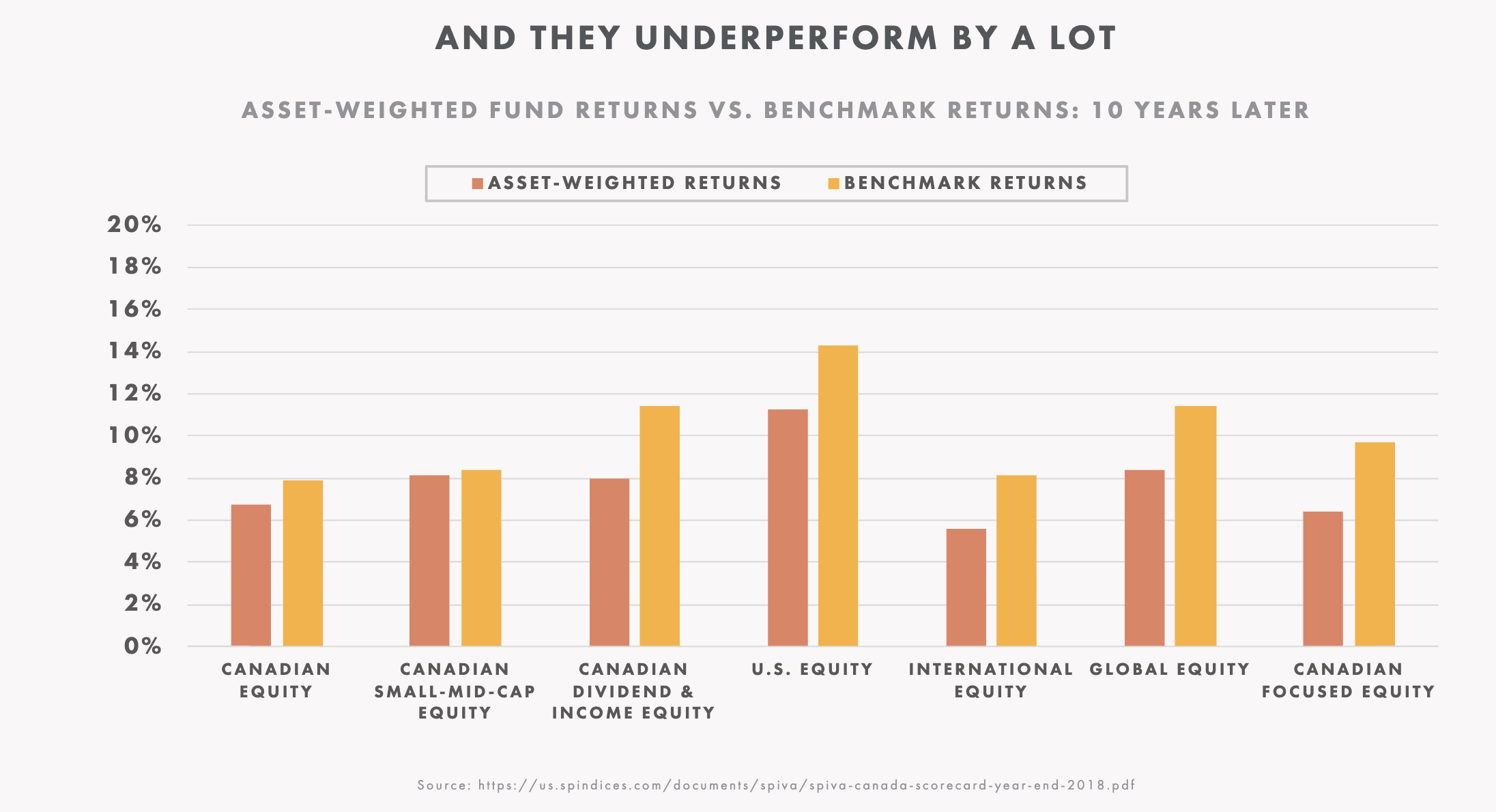

Maggie your cheapest option is still the e-Series version of the TD US. Canadian index mutual funds do show better long-run performance than many actively managed mutual funds. RBC Canadian Index Fund RBF556.

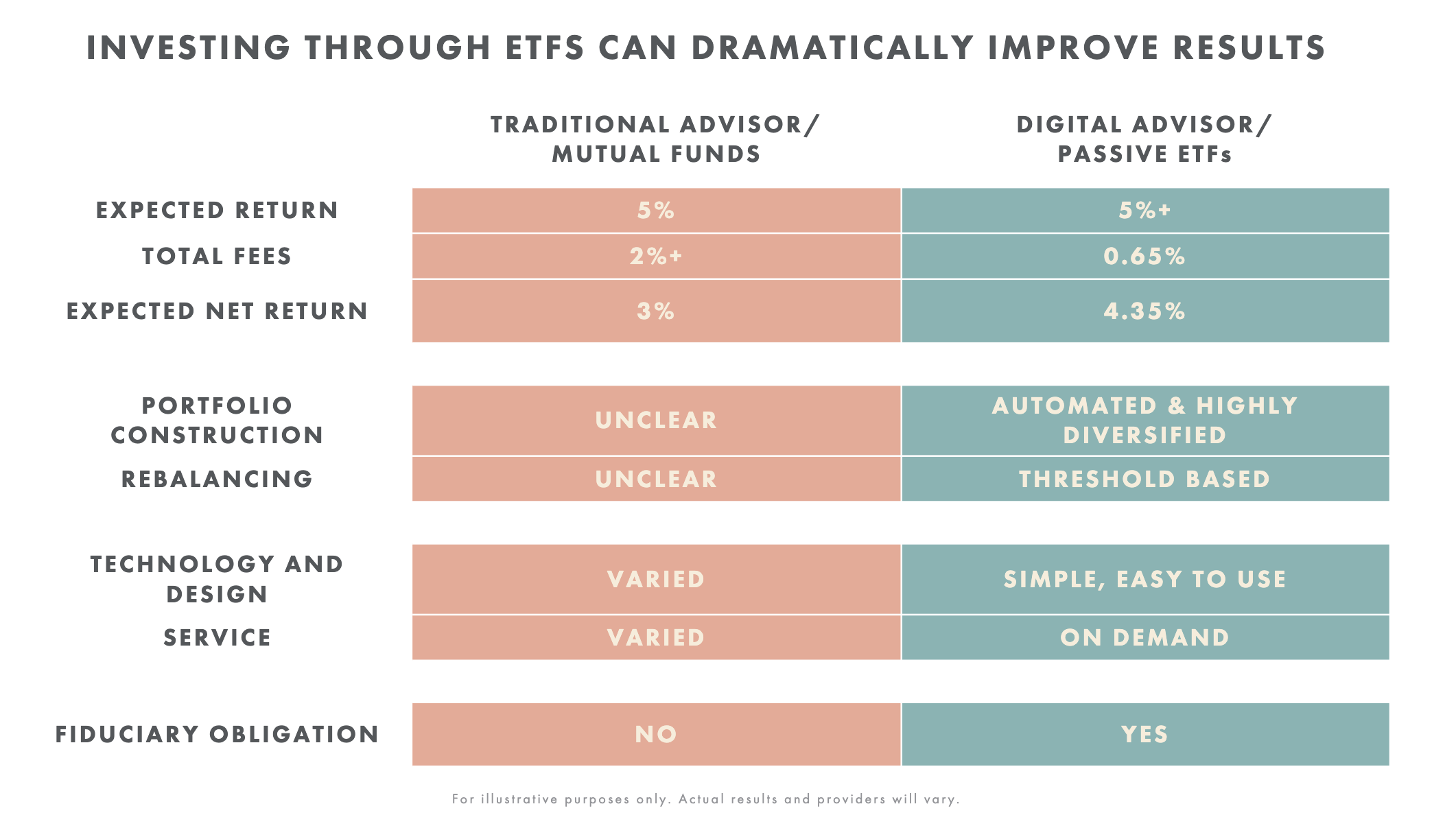

Index funds allow investors to mimic the performance of one or more of these indices typically at a much lower cost than an actively managed mutual fund. Both ETFs and index funds aim to reduce costs for the investor. The three best SP 500 based index funds are VFINX FXAIX and SWPPX.

Index funds are a type of mutual fund that holds a pool of investments from a specific index on the stock market. Fund based in Luxemburg and it offers tokens CIX100 with buy-back option and it. The e-Series mutual funds have long been the cost leader in Canada.

Both offer a wide choice of markets and asset classes. What is Index investing and why should we be buying Canadian index funds. Large growth index funds usually track the Russell 1000 Growth index the Nasdaq Composite or the Nasdaq-100These are investing in the largest US.

Therefore with these funds youll get many of the same stocks as in SP 500 index funds but these will be only growth stocks which tend to be more. A sample balanced index portfolio using RBC. ETFs and index funds hold many of the same indices such as the SP 500.

Best index fund in Canada for broad international equity markets. These kinds of funds track a particular market index such as the SP 500 or the Dow Jones Industrial Average. Cheapest Large Growth Stock Index Funds.

ETFs and index funds both hold less risk than individual stocks and bonds. This fund tracks the AI-Based cryptocurrency index called CIX100. Maintaining a portfolio of index funds will usually run you 005 to 025 annually while actively managed funds can charge 1 to 2.

The MER on this fund is. Learn more about how to buy index funds in Canada or invest in ETFs if you want to track indices online. In theory an index fund or ETF will hold a basket of stocks bonds commodities or other investments that mirror a particular benchmark index whose performance youre trying to replicate.

VFINX is the godfather. Simply put index investing is a passive strategy that attempts to replicate the returns of a particular index. VFINX was the first index fund that was made available to the public.

Discover Benzingas picks for the best index funds you can buy for May 2021 based on 1 and 5 year returns expense ratios and more. Bogle had studies markets and noticed that many investors and managers of. The Vanguard 500 Index Fund Admiral Shares.

Canadian index mutual funds are specialized mutual funds that aim to equal the performance of a Canadian market index such as the SPTSX 60. CBQ Claymore BRIC ETF tracks the BNY BRIC Select ADR Index Brazil Russia India and China. They also come with built-in diversification consistent results and low volatility.

It is also one of the most effective ways to diversify your holdings. Index funds are powerful investments for investors who prefer to take a passive approach to their portfolio.

What Are Mutual Funds How To Invest In Them Wealthsimple

What Are Mutual Funds How To Invest In Them Wealthsimple

Is Your Etf Actually Diversified Morningstar

Is Your Etf Actually Diversified Morningstar

Canadian Versions Of Lazy Portfolios Bogleheads

Canadian Versions Of Lazy Portfolios Bogleheads

Canadian Mutual Fund Etf And Stock Data Provider Fundata Canada Inc

Canadian Mutual Fund Etf And Stock Data Provider Fundata Canada Inc

Getting Returns On Your Mutual Funds Td Canada Trust

Getting Returns On Your Mutual Funds Td Canada Trust

Index Fund Options For Beginner Investors In Canada Investing In Stocks Investing Money Investing

Index Fund Options For Beginner Investors In Canada Investing In Stocks Investing Money Investing

Regular Contribution Threshold For Etf Vs Index Mutual Fund Personal Finance Money Stack Exchange

Regular Contribution Threshold For Etf Vs Index Mutual Fund Personal Finance Money Stack Exchange

Investing Series Index Funds Comparing Td E Series To Ishares To Vanguard In Canada Save Spend Splurge

Investing Series Index Funds Comparing Td E Series To Ishares To Vanguard In Canada Save Spend Splurge

What Are Mutual Funds How To Invest In Them Wealthsimple

What Are Mutual Funds How To Invest In Them Wealthsimple

S P Tsx Composite Index Wikipedia

S P Tsx Composite Index Wikipedia

The Top Canadian Index Funds To Buy For May 2021 Stocktrades

The Top Canadian Index Funds To Buy For May 2021 Stocktrades

The Top Canadian Index Funds To Buy For May 2021 Stocktrades

The Top Canadian Index Funds To Buy For May 2021 Stocktrades

Top 7 Canadian Etfs You Should Own In 2021 Personal Finance Freedom

Top 7 Canadian Etfs You Should Own In 2021 Personal Finance Freedom

Swisscanto Ch Index Fund Ii Swisscanto Ch I Ch0215804383

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.