This is generally done by allotting preferred stock. The first time when company ownership is offered to external investors.

Going From Seed To Series A In Europe By Andy Leaver Medium

Series A investors typically purchase 10 to 30 of the company.

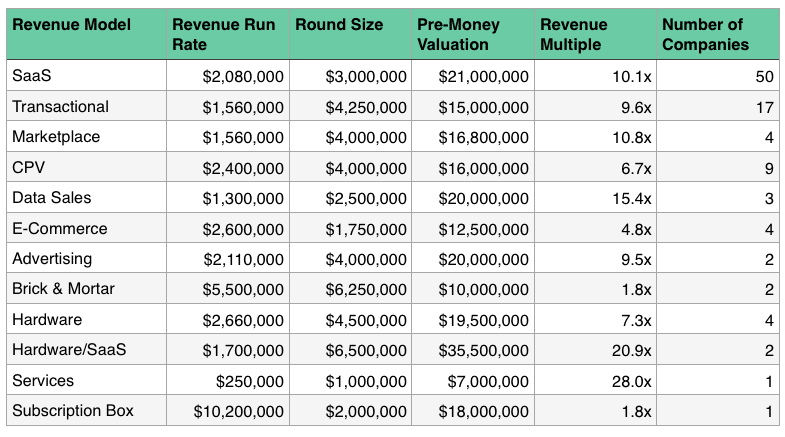

Series a companies. Typically a company in Series A funding sets a goal of raising between 2 - 15 million dollars. The average Series A funding. Names are redacted to preserve confidentiality.

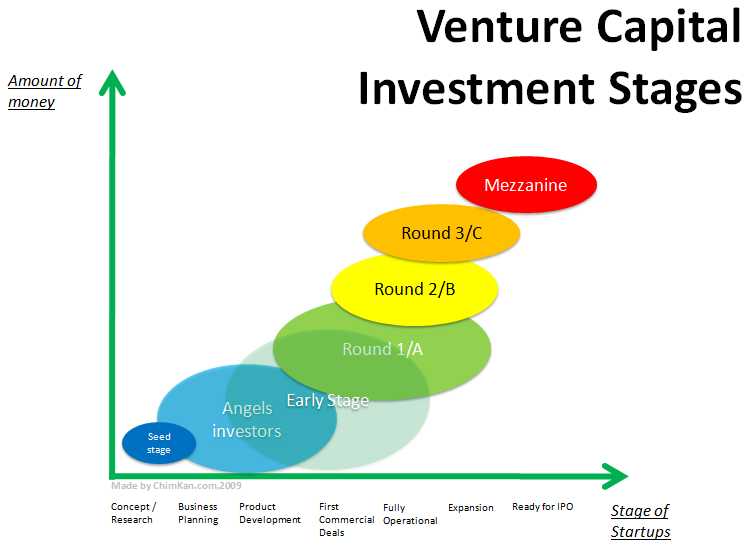

Early stage businesses often raise tens of thousands of dollars from friends and family or hundreds of thousands of dollars from angel investors but VCs usually seek to invest millions of dollars. While there are hundreds of venture capital firms in the US. Series A rounds are traditionally a critical stage in the funding of new companies.

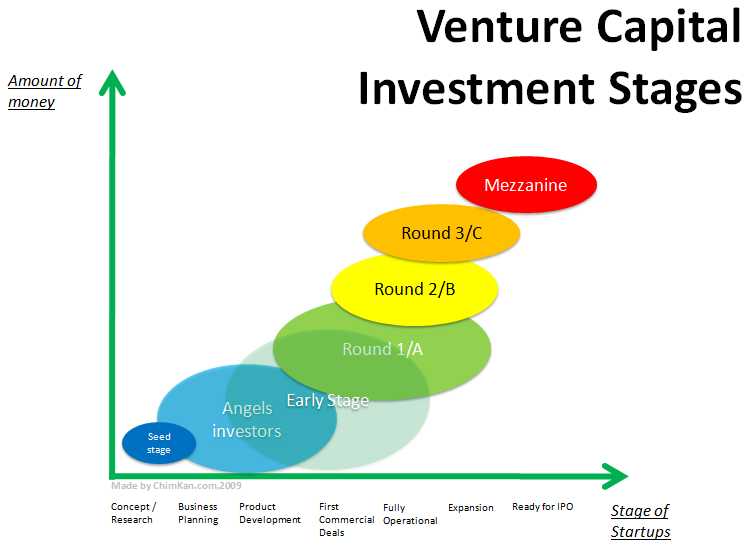

At the series A stage and later investors are looking for a clear path to growth and scale. Startups usually issue preferred shares that do not provide their owners with voting rights. Below is aggregate data on these 99 raises.

For scale a minimum scale that investors are looking for is very company-specific. When you invest time and resources to secure Series A funding youll be talking to established venture capital firms. In series A funding it is important to have a business plan that will generate sustainable profit.

This means that a company secures the required capital from investors by selling the companys shares. During the seed stage you experiment with. Series A round of financing is the first round of financing that a startup receives from a venture capital firm ie.

What Is Series A Funding. Over the last 3 months May to July weve had conversations with 99 companies about leading or following their Series A rounds. This number can vary across industries.

In fact the average Series A funding in 2018 was more than 11 million. To find benchmarks its best to triangulate from peers and investor conversations. Once the startup has developed a track record the company can move on to series A funding to optimize product offers.

Shaw 1 and Kleiner Perkins 2 which manage multi-billion-dollar portfolios. Series A funding is the stage in the capital-raising process by a start-up after seed funding. Typically Series A rounds raise approximately 2 million to 15 million but this number has increased on average due to high tech industry valuations or unicorns.

Series A funding helps establish your startups initial growth ladder through funding for additional headcount product development and acquisition channel investments. To receive Series A funding a company will typically have met the following benchmarks. Series A funding is the first round of series financing for a startup company.

Figures like revenue valuation and round size are medians from the conversations. Series A financing is a type of equity-based financing. This is the first round of funding that a company will receive after its seed round when it has proven its concept and begins full operations.

The VCs you speak to should ideally have a proven track record of successful investments in. Based on the average Series A startup valuation in 2019 Series A startups have an average pre-cash valuation of 22 million. Series A financing comes from well-established venture capital VC and private equity PE firms such as DE.

However in most cases series A financing comes with anti-dilution provisions. Alone here is a listing of hundreds of VC firms Some of the biggest Series A investors in software startups include Accel 500 Startups Bessemer Venture Partners Andreessen Horowitz and Greycroft Partners. For growth its about showing that you have a credible path.

While most startups before this stage have generated only passing interest on the part of large investors Series A funding creates competition between funds. Viele übersetzte Beispielsätze mit series company Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. How to find Series A Investors.

Series A is the first step to get to the major leagues of venture capital. 1 The capital raised during a series A is usually intended to capitalize the company for 6 months to 2 years as it develops its products performs initial marketing and branding hires its initial employees and.

What Does Series A Series B Series C Funding Mean In Startups Startup Freak

What Does Series A Series B Series C Funding Mean In Startups Startup Freak

What Does Series A Series B Series C Funding Mean In Startups Startup Freak

What Does Series A Series B Series C Funding Mean In Startups Startup Freak

The Series A Report Crunchbase

The Series A Report Crunchbase

Benchmarking Exceptional Series A Saas Companies By Ttunguz

Benchmarking Exceptional Series A Saas Companies By Ttunguz

Here S How Likely Your Startup Is To Get Acquired At Any Stage Techcrunch

Here S How Likely Your Startup Is To Get Acquired At Any Stage Techcrunch

The Series A Process Y Combinator

The Series A Process Y Combinator

Series A B C D E Funding Startup Funding Series Explained

Series A B C D E Funding Startup Funding Series Explained

Series A B C Funding Averages Investors Valuations

Series A B C Funding Averages Investors Valuations

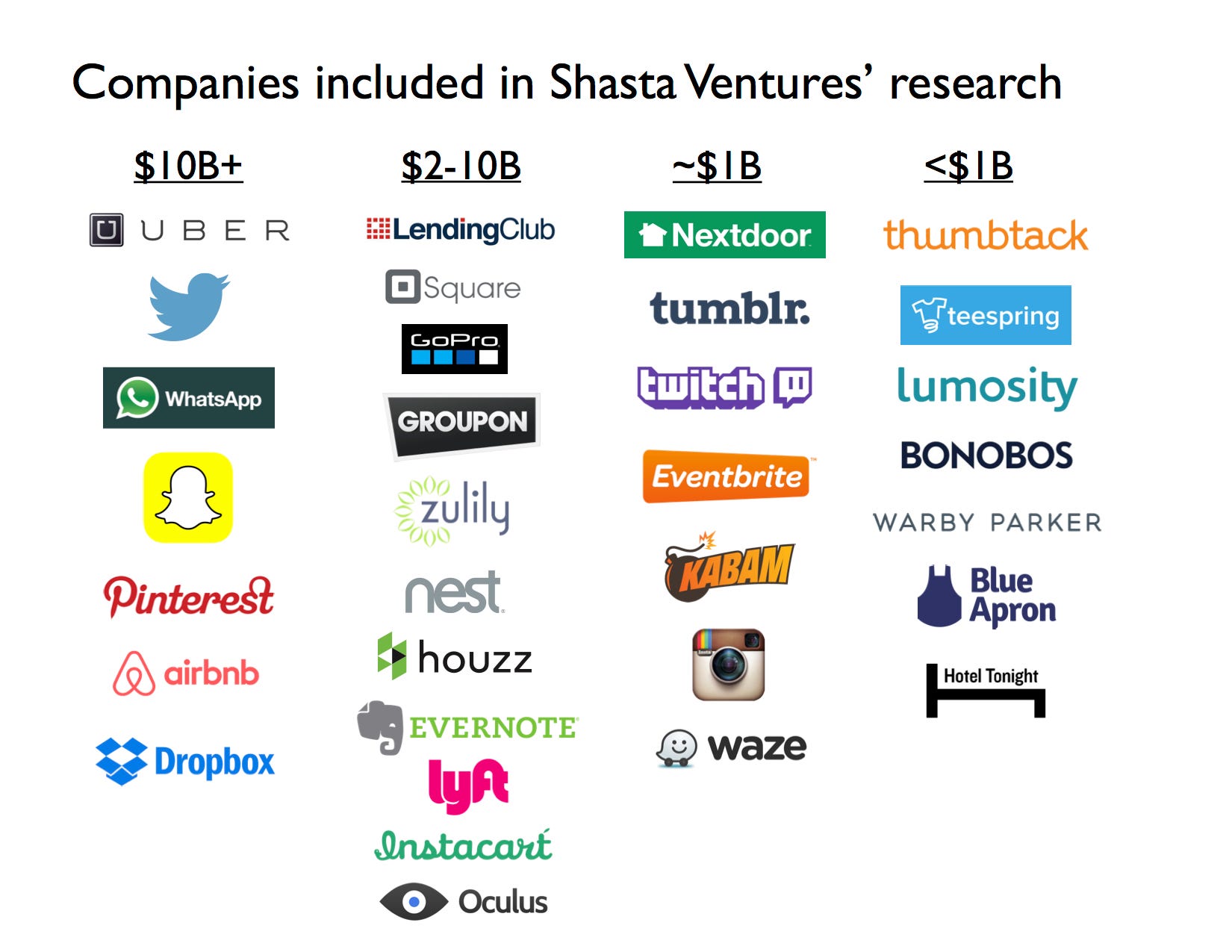

What Did Billion Dollar Companies Look Like At The Series A By Tod Francis Female Founders Lead The Way Startups Pitching Marketing Building Investing Medium

What Did Billion Dollar Companies Look Like At The Series A By Tod Francis Female Founders Lead The Way Startups Pitching Marketing Building Investing Medium

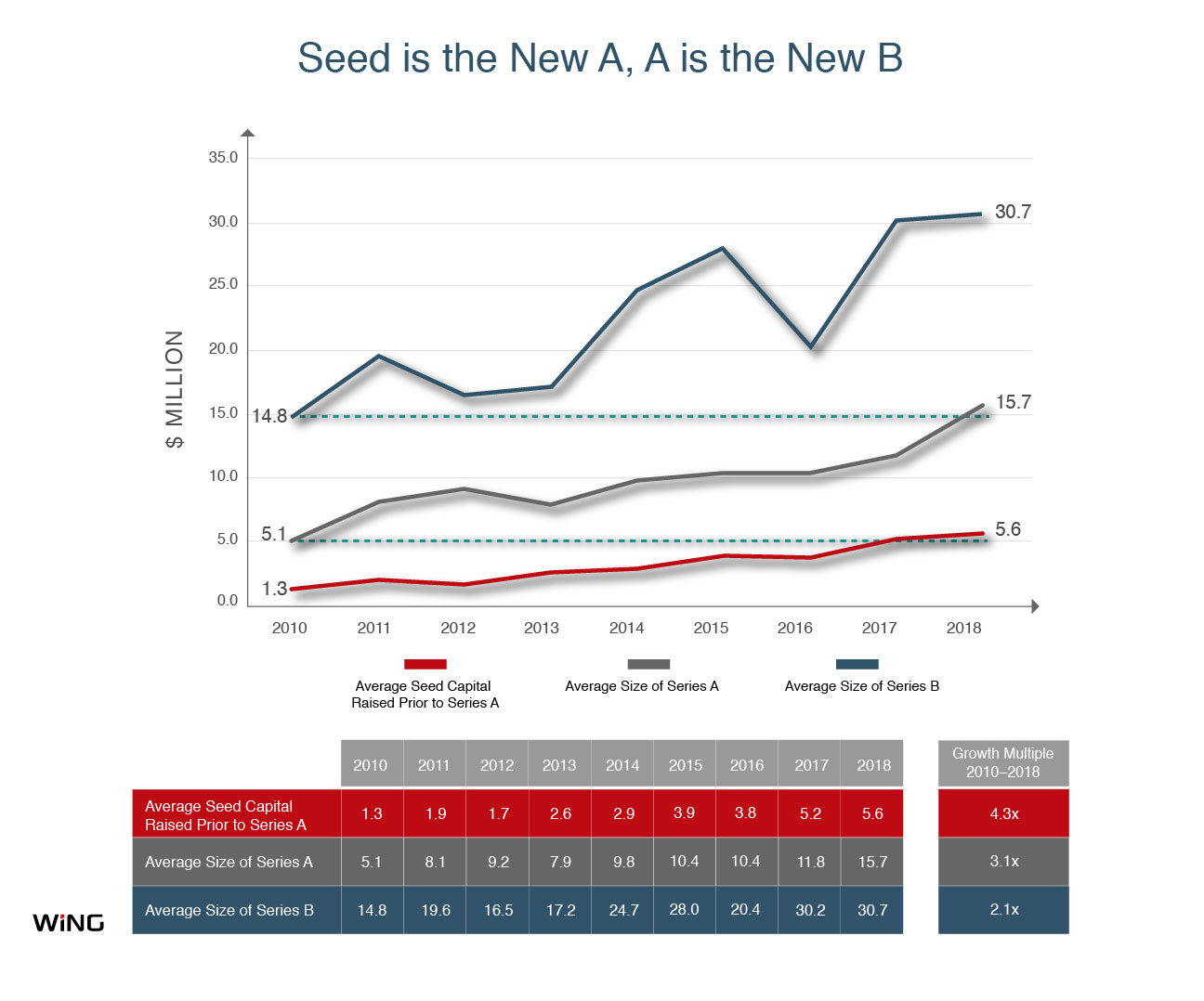

A Quick Look At How Series A And Seed Rounds Have Ballooned In Recent Years Fueled By Top Investors Techcrunch

A Quick Look At How Series A And Seed Rounds Have Ballooned In Recent Years Fueled By Top Investors Techcrunch

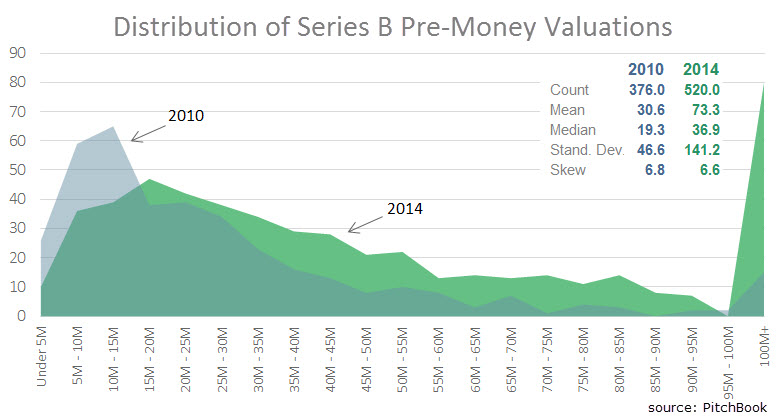

The Series A B C Valuation Distribution For U S Companies Is Moving Pitchbook

The Series A B C Valuation Distribution For U S Companies Is Moving Pitchbook

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.