When buying supplies or materials that will be resold businesses can issue resale certificates to sellers and are not liable for sales tax. A national retail sales tax is a consumption tax collected as a flat-rate tax on all sales from businesses to households.

National Sales Tax By Jenna Shea

National Sales Tax By Jenna Shea

T he United States should introduce a 5 percent national sales tax.

National sales tax. Also known as a value added tax VAT this sales tax would apply to goods and services at. Anzeige Streamline Automate Sales Tax Filing In Multiple Countries. In their place a new national sales tax NST of 15 percent would be charged on the final purchase of all goods and services at the retail level.

Retail sales are business sales to households. For example the sale of a newly constructed home to a family that will occupy it is a retail sale. National Average Sales Tax at 545 While 201 Localities Changed Indirect Tax Policies.

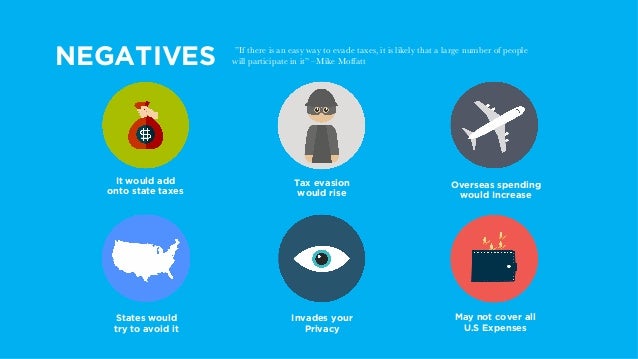

Needs a National Sales Tax Instead of a State-by-State System Im not a fan of federal government. Tax code said it is very unlikely that a national sales tax or European-style value-added tax would win favor over the current income tax system. On top of their state sales tax 38 states also collect local sales taxes.

Federal Income Tax National Sales Tax. Sales tax rate remained unchanged in the fourth. In other words end consumers pay sales tax when they purchase goods or services.

Anzeige Streamline Automate Sales Tax Filing In Multiple Countries. The national sales tax would fall between 23 and 30. Sales Tax.

A national sales tax would be a consumption tax meaning that people would pay it every time they. But lets ease the administrative burden of filing in 50 different states and end. There would be a.

Why the US. It could replace the income tax and the 62 employee portion of the Social Security tax. A national sales tax would apply to all purchases so theoretically the national sales tax could bring in.

Poor people pay. While the average US. US life insurers review their Japan strategy I advocate a single national sales tax as the most equitable system for raising revenue.

Neither business-to-business nor household-to-household transactions qualify. Sales tax is collected by the retailer when the final sale in the supply chain is reached. 181 Zeilen This page displays a table with actual values consensus figures forecasts.

The top five states with the highest sale state and local tax rates are.

National Sales Tax Tax Guru Ker Tetter Letter

Would A Federal Sales Tax Be More Equitable Than The Current Federal Income Tax Debate Org

Would A Federal Sales Tax Be More Equitable Than The Current Federal Income Tax Debate Org

National Sales Tax International Liberty

Who Bears The Burden Of A National Retail Sales Tax Tax Policy Center

Who Bears The Burden Of A National Retail Sales Tax Tax Policy Center

Could The U S Ever Adopt A National Sales Tax

Could The U S Ever Adopt A National Sales Tax

Why We Must Abolish The Income Tax And The Irs A Special Report On The National Sales Tax Hultberg Nelson 9781891191480 Amazon Com Books

Why We Must Abolish The Income Tax And The Irs A Special Report On The National Sales Tax Hultberg Nelson 9781891191480 Amazon Com Books

Jesse Ventura On Twitter What S Best A National Sales Tax Flat Tax Progressive Tax Or Trump S New Tax Policy Read Http T Co C6jmeftacq Http T Co Vyoqmmprmh

Jesse Ventura On Twitter What S Best A National Sales Tax Flat Tax Progressive Tax Or Trump S New Tax Policy Read Http T Co C6jmeftacq Http T Co Vyoqmmprmh

Could The U S Ever Adopt A National Sales Tax

Could The U S Ever Adopt A National Sales Tax

Why Amazon And Other Retailers Are Supporting This National Sales Tax Legislation Geekwire

Why Amazon And Other Retailers Are Supporting This National Sales Tax Legislation Geekwire

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Could The U S Ever Adopt A National Sales Tax

Could The U S Ever Adopt A National Sales Tax

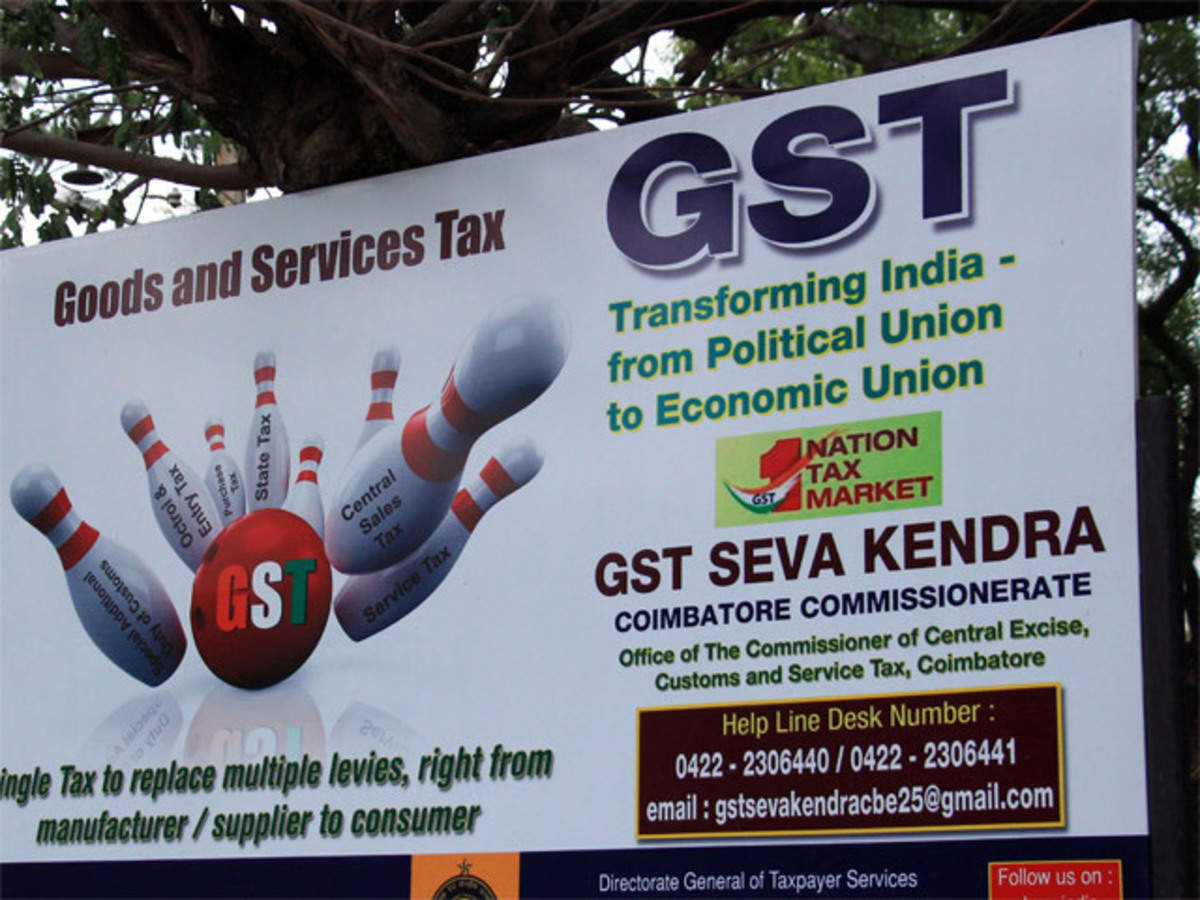

Gst Good Bad And Ugly Of India S New National Sales Tax Journey The Economic Times

Gst Good Bad And Ugly Of India S New National Sales Tax Journey The Economic Times

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.