Take a summer and winter courses btake fewer courses per semester cseek out government d. It is a tax-advantaged way for families to invest money for their childrens future college costs.

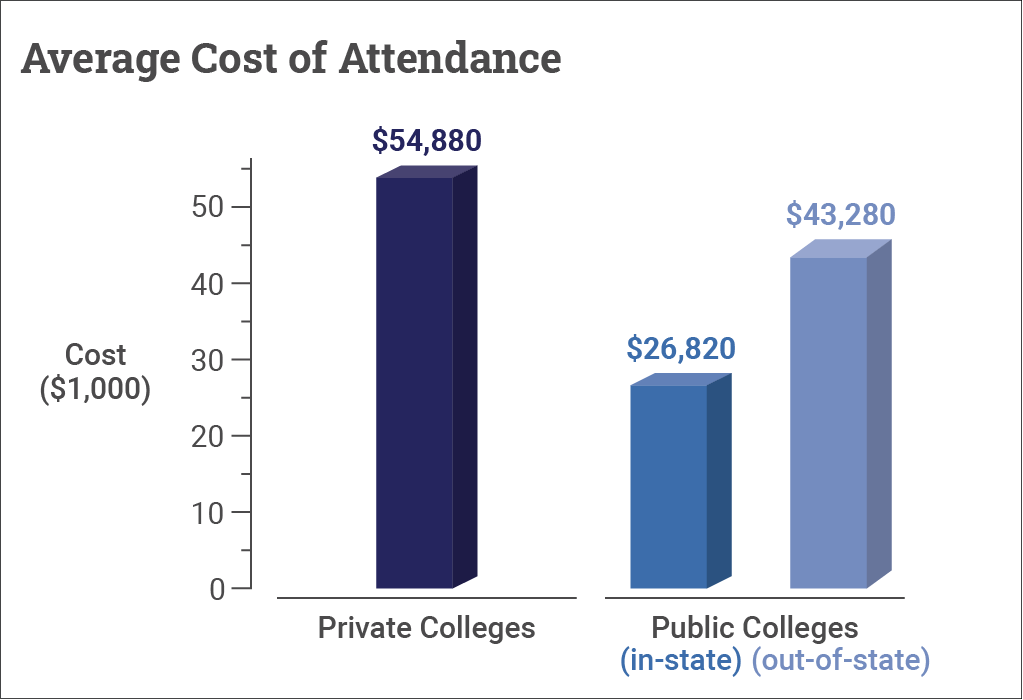

How Much Does College Cost Collegedata

How Much Does College Cost Collegedata

529 plans are established and maintained by state governments state agencies and higher education institutions.

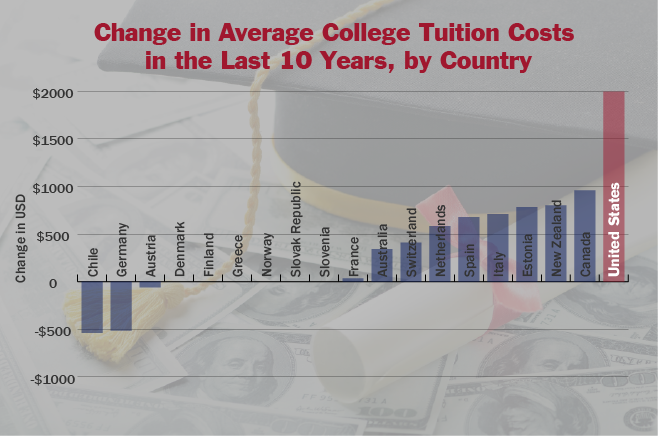

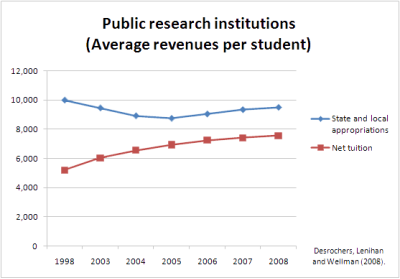

What is one way to limit college tuition costs. What is one way to limit college tuition cost. Declining public funds have caused college tuition to skyrocket leaving many families either with insurmountable student loan debt or unable to afford a higher education altogether. The maximum amount you can claim for the tuition and fees adjustment to income is 4000 per year.

The deduction is further limited by income ranges based on your modified adjusted gross incomes MAGIs. Advanced Placement AP High School. Looking ahead to 2021-2022 tuition rates families can expect much of the same as colleges may take a similar approach by freezing tuition or applying only small increases.

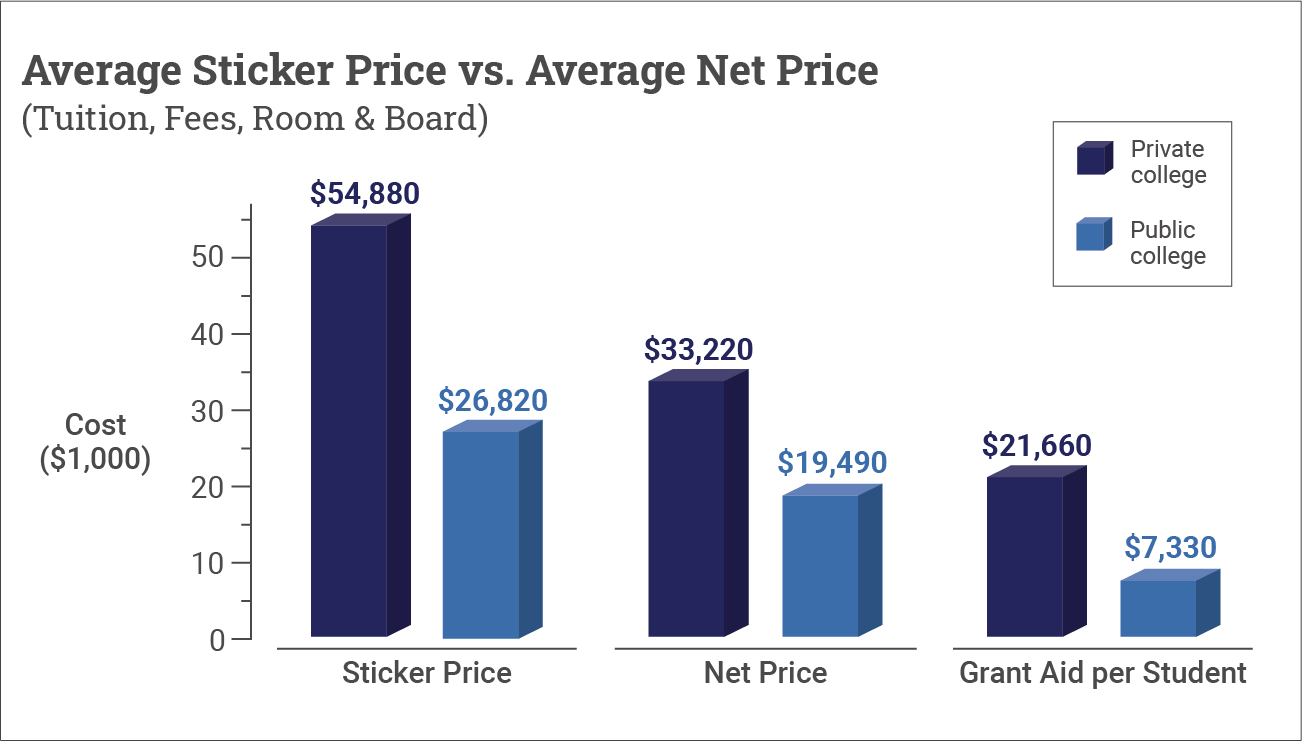

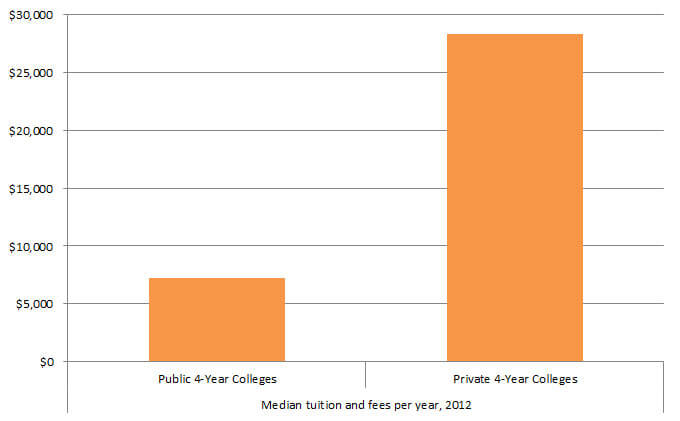

The deduction is worth either 4000 or 2000 depending on your income and filing status. In looking just at schools ranked in the National Universities category for example the average cost of tuition and fees for the 20202021 school year was 41411 at private colleges. Gary Becker the Nobel laureate economist and Richard Posner the federal judge and author have recently argued that one solution to the tuition conundrum may be to allow public schools to charge a range of tuition prices like private schools do based on the familys ability to pay.

High-income individuals may find that they dont qualify for this deduction. However there is a simple way to control the rise in tuition - alignment of incentives for both. Florida State UniversityTallahassee FloridaAnnual College Costs Fall 2009In-state tuition and fees.

Restoring private lending will make the loan market more responsible and cause colleges to rein in costs creating more affordable choices for students. Seek out state loans. Those who invest in the plan are exempt from paying federal taxes on it and receive certain state tax benefits.

4566Out-of-state tuition and fees. Tuition and Fees Deduction A taxpayer whose modified adjusted gross income is greater than80000 if single head of household or qualifying widower or 160000 if married filing a joint return cannot take this deduction. Private lending will also limit taxpayers.

The fact is college tuition is expensive and it will keep rising unless major change happens. Some college tuition and fees are deductible on your 2020 tax return.

Why Free College Could Increase Inequality Third Way

Why Free College Could Increase Inequality Third Way

How Much Does College Cost Collegedata

How Much Does College Cost Collegedata

Beyond Tuition Center For American Progress

Beyond Tuition Center For American Progress

5 Ways To Reduce College Tuition Costs Fox Business

5 Ways To Reduce College Tuition Costs Fox Business

How Free College Tuition In One Country Exposes Unexpected Pros And Cons

How Free College Tuition In One Country Exposes Unexpected Pros And Cons

Free Higher Education Bad Idea Unless You Want Government To Restrict Access Ncee

Free Higher Education Bad Idea Unless You Want Government To Restrict Access Ncee

See The Average College Tuition In 2020 2021 Paying For College Us News

See The Average College Tuition In 2020 2021 Paying For College Us News

How Much Does College Cost Collegedata

How Much Does College Cost Collegedata

Free College Does Not Eliminate Student Debt Urban Institute

Free College Does Not Eliminate Student Debt Urban Institute

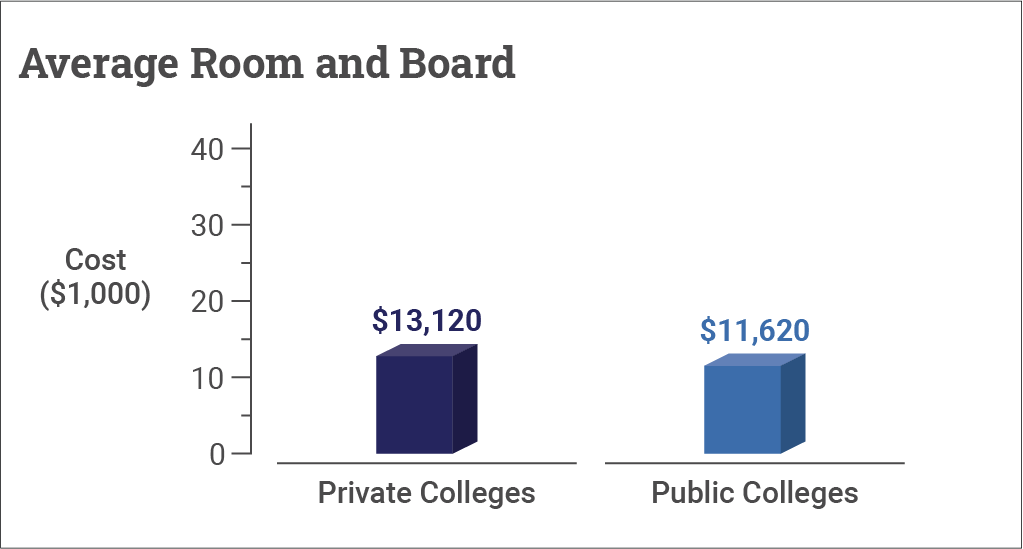

/understanding-college-tuition-room-and-board-8da9a2f7ae914adfa5acbd0e6ea9cb42.png) The Basics Of College Tuition Room And Board

The Basics Of College Tuition Room And Board

College Tuition In The United States Wikipedia

College Tuition In The United States Wikipedia

What Is One Way To Limit College Tuition Costs Frank Financial Aid

What Is One Way To Limit College Tuition Costs Frank Financial Aid

How To Make College Cheaper Paying For College Us News

How To Make College Cheaper Paying For College Us News

39 Ways You Can Cut The Cost Of College

39 Ways You Can Cut The Cost Of College

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.